Accounting firms face mounting pressure to modernize their technology infrastructure while maintaining strict security standards. The right IT solutions for accounting firms can streamline operations, protect sensitive financial data, and improve client service delivery.

We at Clouddle see firms struggling with outdated systems that slow down productivity and create compliance risks. This guide covers the essential technology investments that will transform your practice.

Essential IT Infrastructure for Accounting Firms

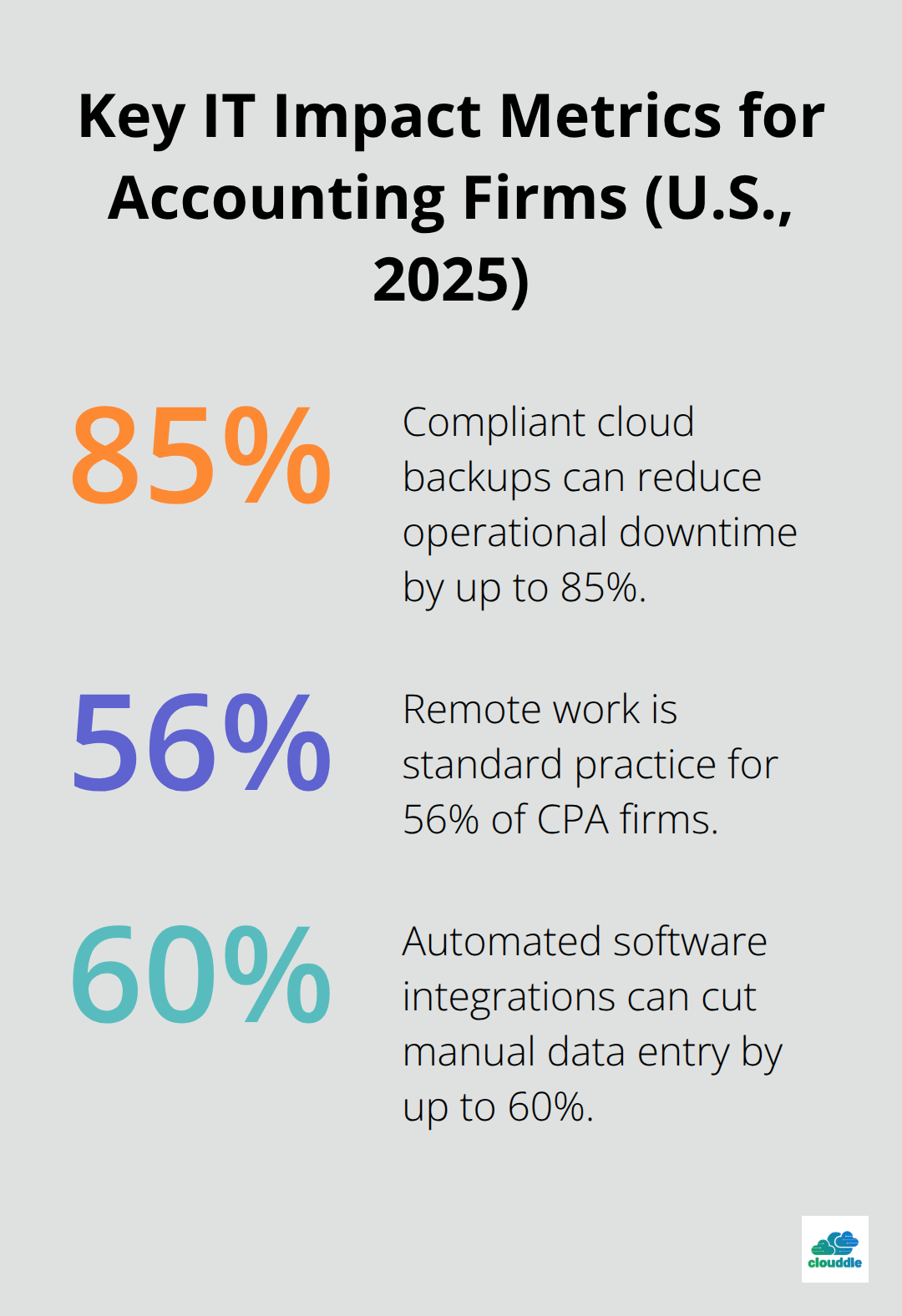

Cloud computing has become non-negotiable for accounting firms, with industry data showing widespread adoption across practices in 2025. The shift away from on-premise servers eliminates the need for costly hardware maintenance while providing scalable storage that grows with your client base. Microsoft Azure and Amazon Web Services offer specialized compliance features that meet financial industry requirements, including automated backup systems that reduce operational downtime by up to 85% as reported by Gartner. Modern accounting firms should prioritize hybrid cloud architectures that keep sensitive data encrypted while allowing remote access for staff who work from multiple locations.

Network Security That Actually Works

Accounting firms experience cyber-attacks 300 times more frequently than other sectors according to Boston Consulting Group research, which makes robust network security your most important investment. Multi-layered firewall protection combined with intrusion detection systems can prevent the majority of attempted breaches before they reach your financial data. Advanced threat monitoring tools now use artificial intelligence to identify suspicious activity patterns, while endpoint protection software secures every device that connects to your network. The average cost of comprehensive network security ranges from ,000 to ,000 annually for mid-sized firms (but this investment prevents potential losses that could reach millions from a single data breach).

Hardware Strategy for Maximum Efficiency

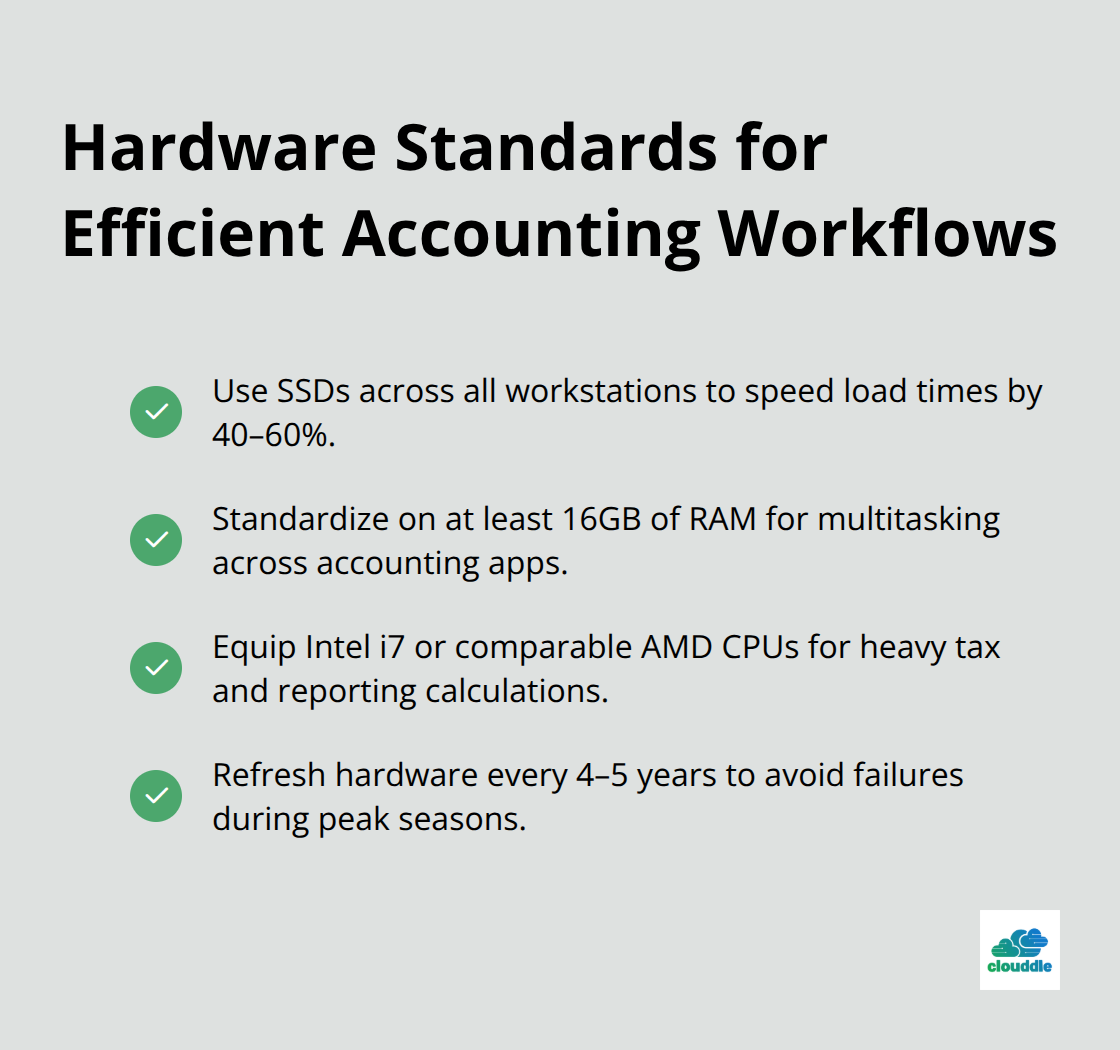

Modern accounting practices need reliable hardware that supports intensive financial software without performance bottlenecks. Solid-state drives should replace traditional hard drives in all workstations to improve software loading times by 40-60%, while 16GB of RAM has become the minimum standard for running multiple accounting applications simultaneously. Firms that process high volumes of tax returns during peak season require workstations with Intel i7 processors or AMD equivalents to handle complex calculations efficiently.

Regular hardware refresh cycles every 4-5 years prevent unexpected failures during critical periods like tax season (when downtime costs can exceed $10,000 per day for busy practices).

With your infrastructure foundation in place, the next step involves selecting and integrating the software solutions that will transform how your team manages client relationships and processes financial data.

Software Solutions for Modern Accounting Practices

QuickBooks Online dominates small accounting practices, but firms that handle complex client portfolios need enterprise solutions like Sage Intacct or NetSuite that support multi-entity consolidations and advanced reports. Integration between your primary platform and specialized tools like CCH Axcess creates unified workflows that eliminate duplicate data entry and reduce errors through automation. Automated bank reconciliation and invoice processing through platforms like MindBridge AI can process thousands of transactions in minutes rather than hours, while API connections between tax software and practice management systems streamline year-end workflows.

Client Portals That Drive Efficiency

ShareFile and similar secure portals have replaced email for document exchange, but the best solutions integrate directly with your software to track document requests and approvals. Modern client portals should include real-time financial dashboards that give clients 24/7 access to their key metrics without support calls to your staff. Automated client onboarding workflows through platforms like Karbon can reduce new client setup time from weeks to days, while integrated e-signature capabilities through DocuSign or Adobe Sign eliminate the delays that paper-based approval processes cause.

Document Management Systems That Scale

Optical character recognition technology in tools like Dext and Receipt Bank can extract data from invoices and receipts with over 99% accuracy and feed information directly into your systems without manual entry. Cloud-based document management through Microsoft SharePoint or similar platforms should include version control and audit trails that meet compliance requirements while multiple team members collaborate on client files simultaneously. Automated workflow rules can route documents for approval based on dollar amounts or client types (which reduces bottlenecks during peak periods when partners become overwhelmed with routine approvals).

Communication Tools for Modern Teams

Unified communication platforms like Microsoft Teams or Slack integrate with your practice management software to centralize client discussions and project updates. Video conferencing capabilities through Zoom or similar platforms should connect directly to your calendar system to schedule client meetings without double-booking conflicts. Mobile apps for your core software allow staff to access client information and approve transactions while working remotely (which has become standard practice for 56% of CPA firms according to AICPA surveys).

Strong software foundations require equally robust security measures to protect the sensitive financial data that flows through these systems daily.

Cybersecurity Best Practices for Financial Data Protection

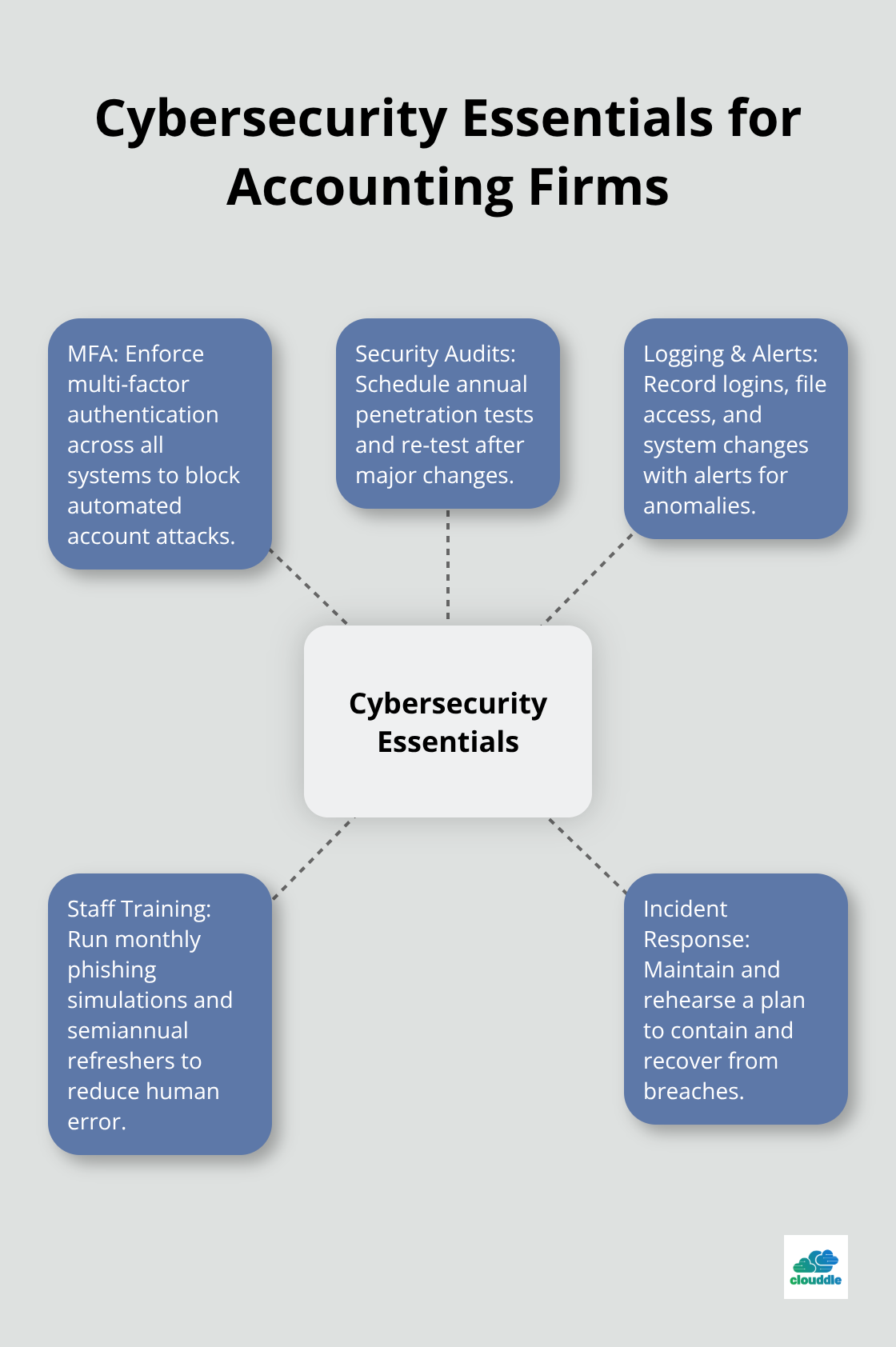

Multi-Factor Authentication Blocks 99.9% of Account Breaches

Microsoft research confirms that multi-factor authentication stops 99.9% of automated attacks, which makes it your strongest defense against unauthorized access to client financial records. Every staff member must enable MFA on all accounting software, email accounts, and cloud storage platforms within 48 hours of implementation. Hardware security keys from YubiKey provide the highest protection level, while smartphone authenticator apps like Microsoft Authenticator offer practical alternatives for remote workers. Role-based access controls should limit staff to only the client files and software features they need for their specific job functions, with quarterly reviews to remove unnecessary permissions as team responsibilities change.

Security Audits Must Occur Annually

Penetration tests should occur at least annually, or after any significant change, with specialized firms that charge $3,000 to $8,000 for comprehensive assessments of mid-sized practices. Automated compliance tools like Rapid7 or Qualys track your adherence to regulations like SOX and GLBA in real-time and generate reports that demonstrate due diligence to clients and regulatory bodies. Security event logs should capture every login attempt, file access, and system change for forensic analysis, with automated alerts for suspicious activities like after-hours database queries or multiple failed login attempts from unfamiliar locations. Use an IT security audit checklist to ensure comprehensive coverage of all critical areas.

Staff Education Prevents 95% of Phishing Attacks

Employee mistakes cause 95% of successful data breaches according to IBM security research, which makes comprehensive education your most cost-effective security investment. Monthly phishing simulation tests through platforms like KnowBe4 or Proofpoint teach staff to recognize sophisticated email attacks that target firms during tax season. Security awareness programs should cover password management, social engineering tactics, and proper procedures for sensitive client communications, with mandatory refresher sessions every six months and immediate retraining after any security incident. Develop a cybersecurity incident response plan to handle breaches effectively when they occur.

Final Thoughts

Smart IT solutions for accounting firms require strategic investment priorities that balance immediate operational needs with long-term growth objectives. Cloud infrastructure and cybersecurity measures should receive first priority, with firms typically seeing 25-40% productivity improvements within six months of implementation. Network security investments pay for themselves through prevented breach costs, while automated software integration reduces manual data entry by up to 60% during peak tax seasons.

Implementation timelines vary based on firm size, but most practices complete core technology upgrades within 90-120 days when they work with experienced providers. Expect initial setup costs of $15,000-$50,000 for comprehensive solutions, with monthly operational expenses that range from $2,000-$8,000 depending on staff size and software complexity. The average ROI reaches 200-300% within 18 months through reduced labor costs and improved client capacity.

We at Clouddle recommend that you start with a comprehensive technology assessment to identify your biggest operational bottlenecks. Clouddle’s managed IT services provide 24/7 support and flexible contracts that eliminate upfront hardware investments while they deliver enterprise-grade solutions. Focus on solutions that integrate seamlessly with your existing workflows rather than force staff to learn completely new systems during busy periods (when productivity matters most).