Network cable installation pricing is one of the toughest decisions service providers face. Get it wrong, and you either leave money on the table or price yourself out of jobs.

At Clouddle, we’ve seen installers struggle with this exact problem. The good news: pricing doesn’t have to be complicated once you understand the core factors that drive costs and what your market will actually pay.

What Really Drives Installation Costs

Labor: Your Biggest Budget Item

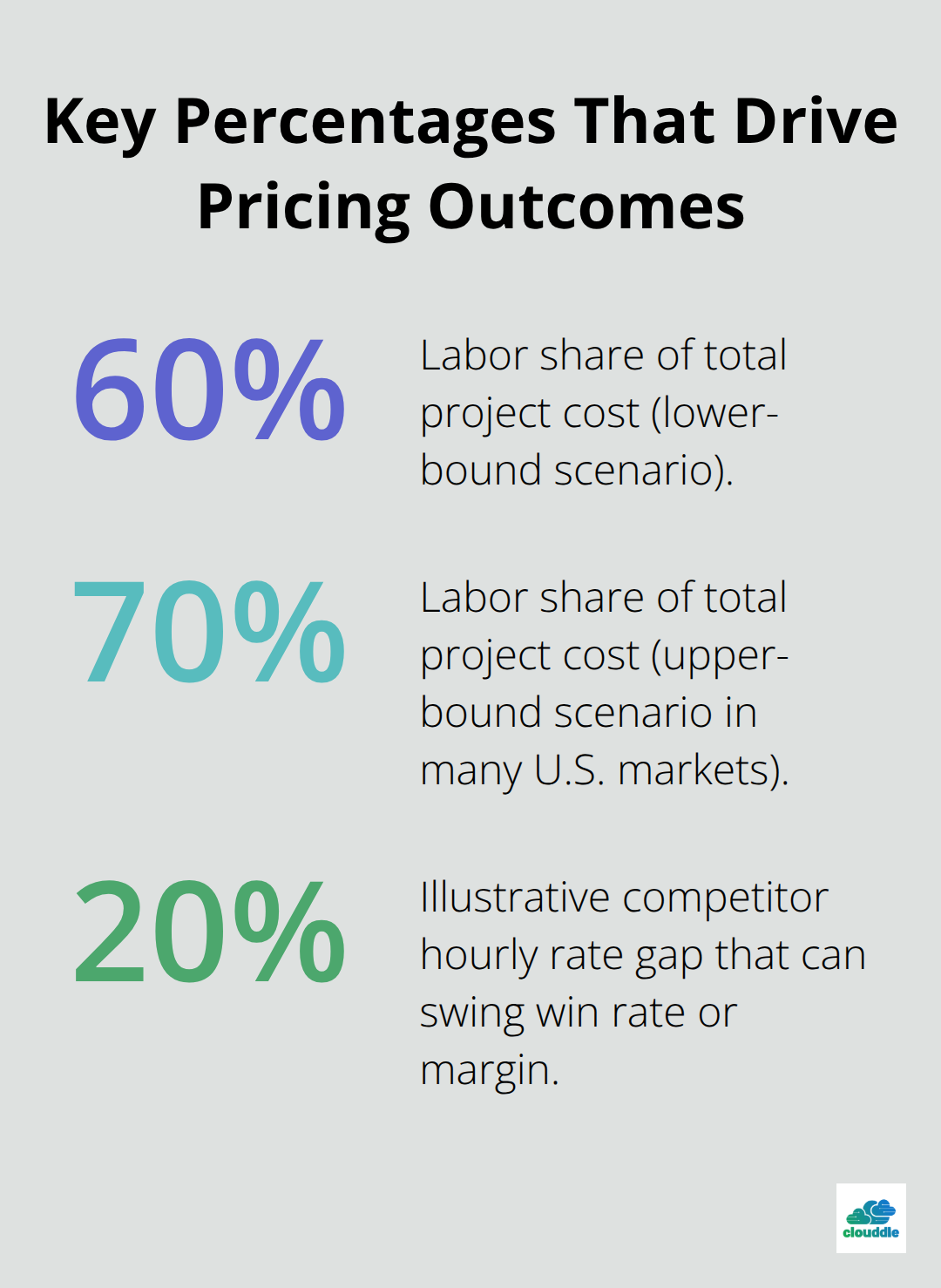

Labor consumption in network cable installation ranges from 60 to 80 percent of total installation costs, making it the single largest expense in any network cable project. The US market shows wide variation, with hourly rates ranging from $30 to $120 depending on location and technician experience. New England commands premium rates due to higher cost of living and demand for skilled labor. A two-person crew bills at $170 per hour in competitive markets like the Greater Toronto Area, while single technicians run closer to $85 per hour. You’re not just paying for time on-site-you’re paying for someone who knows how to route cables through 1960s attics, avoid interference issues, and terminate connections to TIA standards. Inexperienced installers create callbacks and warranty headaches; experienced ones get it right the first time.

Cable Selection and Material Costs

Cable choice directly impacts both material and labor expenses. Cat6 costs roughly $1.00 to $1.55 per foot installed, while Cat6a runs $1.30 to $2.00 per foot and Cat6a cable specifications support 10 gigabit speeds up to 100 meters. Plenum-rated cable adds 20 to 30 percent to your material costs because it requires special termination knowledge and fireproofing compliance. Fiber optic cabling ranges from $0.90 to $6.00 per foot installed, making it 2 to 5 times more expensive than copper but essential for backbone links and long-distance runs. Certifiable brands like Hubbell, Panduit, CommScope, and Belden command higher prices but deliver 25-year manufacturer warranties and proven reliability.

Site Conditions and Project Scope

New construction projects run 30 to 40 percent cheaper than retrofits because walls and ceilings remain accessible during framing. Retrofitting into finished spaces with solid drywall, multiple floors, or limited attic access multiplies labor hours significantly. A detailed site survey before quoting improves accuracy to 90 to 95 percent; phone estimates without site visits commonly trigger change orders worth 15 to 25 percent of the original quote. These variables-building age, accessibility, and cable specifications-determine whether a project runs smoothly or encounters costly delays.

Three Pricing Models That Actually Work

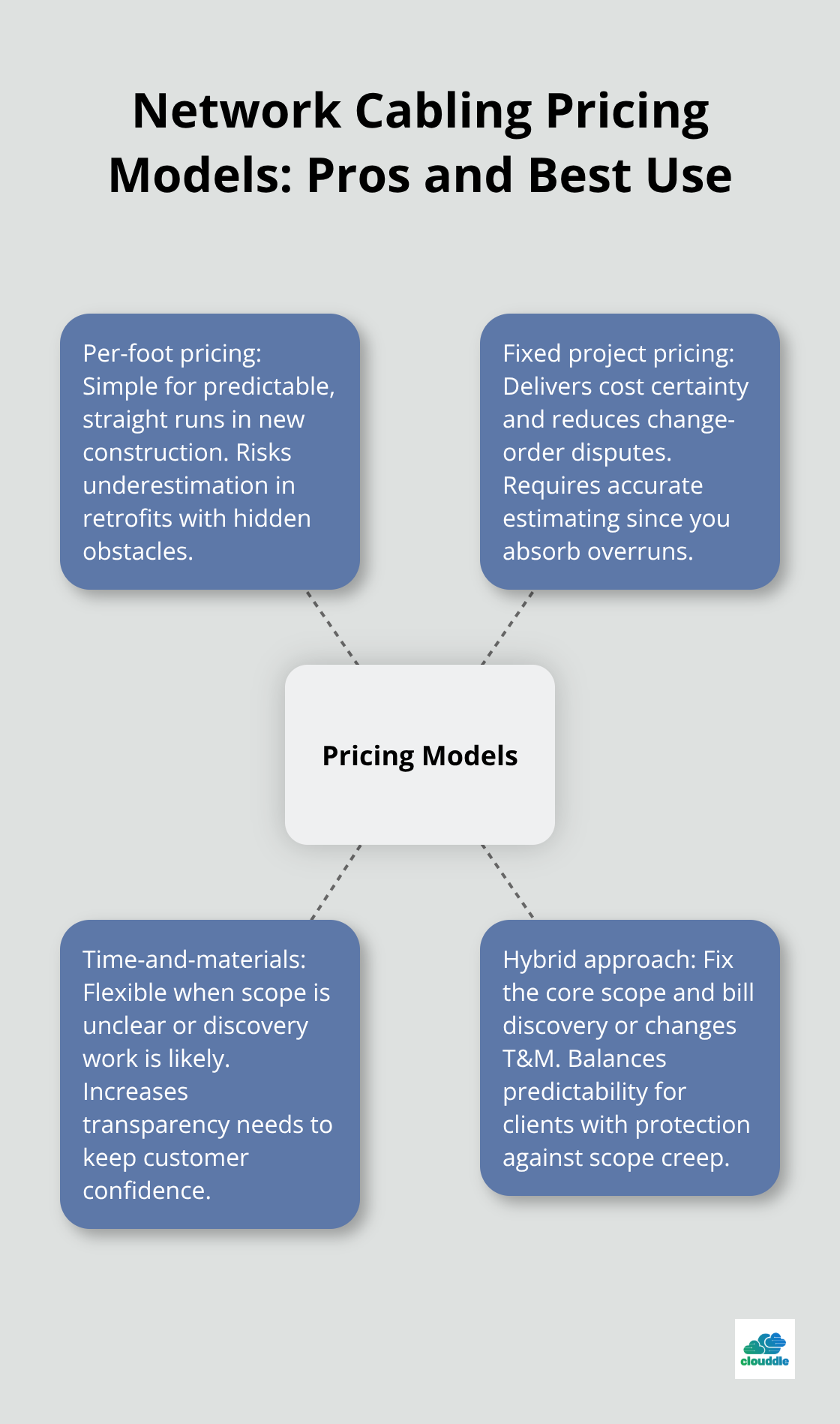

Per-Foot Pricing: Simple but Risky

Per-foot pricing sounds straightforward until reality arrives. You quote $1.20 per foot for Cat6, the customer counts 450 feet on paper, then the actual run requires 680 feet because of wall obstructions, vertical routing through multiple floors, and code compliance for firestop. You either absorb the difference or trigger a change order that damages the relationship. This model works only for straightforward new construction where site conditions remain predictable. For retrofits and older buildings, per-foot estimates become unreliable fast.

The real problem is that customers focus on the per-foot pricing and ignore what actually determines cost: labor hours spent troubleshooting access points and terminating connections. If you use per-foot pricing, add a 15 to 20 percent buffer into your quote and always conduct a site visit before finalizing numbers. This protects your margins and prevents disputes later.

Fixed Project Pricing: Certainty at a Cost

Project-based fixed pricing eliminates change order arguments and gives customers certainty. You quote a total price to install 12 drops with Cat6 cabling, termination, testing, and labeling. The customer knows exactly what they’ll pay. This requires serious accuracy in estimation because you absorb any cost overruns. Labor typically accounts for 60 to 70 percent of project cost, so underestimating hours destroys margins quickly.

A two-person crew in markets like Toronto runs $170 per hour, meaning a project quoted at 20 hours costs $3,400 in labor alone. If the actual job takes 28 hours, you’ve lost $1,360 in profit. Fixed pricing works best when you have historical data from similar projects and you’ve built in realistic contingency. Many installers quote fixed prices without sufficient experience and learn expensive lessons.

Time-and-Materials: Flexibility Over Predictability

Time-and-materials pricing protects you from surprises but frustrates customers who want budget certainty. You charge an hourly rate (typically $85 for one technician, $170 for two) plus material costs marked up 15 to 25 percent. Materials like Cat6 jack plates cost $8 to $18 per unit from certifiable brands like Hubbell or Panduit, or $2 to $4 from generic suppliers. This model works for jobs where scope is genuinely unclear, like retrofits where wall conditions might require additional conduit or where hidden obstacles emerge during installation.

The downside: customers see the meter running and feel anxious about final cost. Transparency matters here. Provide detailed invoices showing labor hours, materials used, and markups. Include travel time as a flat base rate rather than hourly billing; the GTA market uses 1.25 hours base for local jobs and 2.5 hours for outside territory, which prevents disputes over drive time.

Hybrid Approach: The Best of Both Worlds

The best approach combines fixed pricing for defined scopes and time-and-materials for change orders or discovery work. This hybrid model gives customers predictability on core work while protecting you from scope creep. You lock in a price for the main installation, then bill additional work (unexpected conduit runs, extra terminations, or cable rerouting) at hourly rates with material markups. Customers accept this structure because they understand the core scope was fixed and new issues emerged during execution. This strategy maintains margins while preserving relationships, and it positions you to win competitive bids against installers who offer only one pricing method.

Competitive Pricing Strategy and Market Analysis

Your hourly rate means nothing if you don’t know what competitors charge in your geography. The Greater Toronto Area commands $85 per hour for a single technician and $170 per hour for two-person crews, but that same crew rate drops to $60–$100 per hour in secondary markets and climbs to $120+ in high-cost regions like New England. Labor represents 60 to 70 percent of total project cost, so a 20 percent gap in hourly rates between you and competitors directly translates to either losing jobs or sacrificing margin.

Benchmarking Against Industry Standards

Pull actual quotes from three to five competitors in your service area. Not rough estimates-real written quotes for identical scopes like 10 Cat6 drops with termination and testing. Document the hourly rates, per-drop charges, and total project prices. This competitive intelligence tells you whether you’re pricing aggressively, in the middle, or leaving money on the table. Benchmark against the market regularly to ensure your rates remain competitive and your service levels justify your pricing.

Understanding Local Market Rates

Detailed site surveys before quoting improve accuracy to 90 to 95 percent, while phone estimates commonly trigger change orders worth 15 to 25 percent of the original quote. Charge $150 to $300 for a formal survey visit depending on property size and complexity. Most customers accept this fee because they understand it prevents surprises, and you can credit the survey fee against the final project cost if they hire you.

During the survey, photograph cable routes, measure actual distances, and identify obstacles like load-bearing walls or conduit conflicts. Assess building age and construction type carefully-a 1960s house with solid drywall requires different labor estimates than new construction with accessible crawlspaces. This information lets you quote accurately and win jobs against competitors who lowball estimates and encounter problems mid-project.

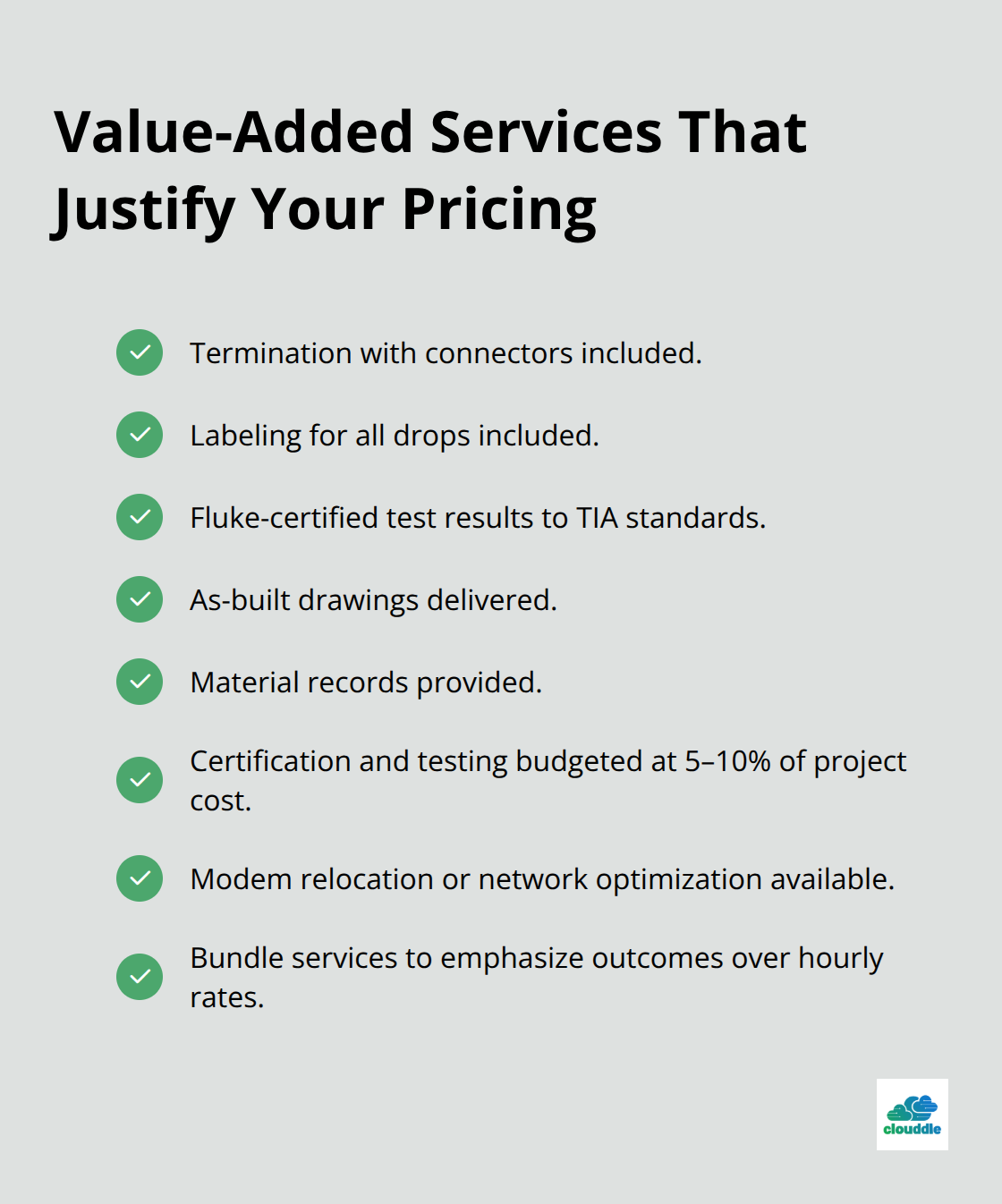

Value-Added Services as Differentiators

Customers who shop purely on hourly rate or per-foot price commoditize your service and destroy margins across your entire portfolio. Instead, package value-added services that competitors either don’t offer or charge separately for. Cable termination pricing includes installing connectors, labeling, and testing-services that require precision and proper equipment.

Offer comprehensive documentation as standard, including as-built drawings, test results with Fluke certification to TIA standards, and material records. Certification and testing typically cost 5 to 10 percent of project cost but provide essential warranty support and accelerate future expansions when customers add more drops. Modem relocation or network optimization services start at $300 and take about 2 hours, which customers often need but don’t think to request.

Bundle these services into package pricing rather than itemizing everything separately. A customer who sees $85 per hour for labor might balk, but a customer who sees a fixed price for full installation, termination, testing, and documentation perceives higher value. You’re no longer competing on rate-you’re competing on outcome and reliability.

Final Thoughts

Network cable installation pricing works best when you treat it as a value problem rather than a cost problem. The installers who win consistently aren’t the cheapest-they’re the ones who quote accurately, deliver predictably, and build customer trust through transparent communication. Your network cable installation pricing strategy should reflect three realities: labor dominates your cost structure at 60 to 70 percent of total project expense, site conditions vary dramatically between new construction and retrofits, and customers will pay premium rates for installers who eliminate surprises and deliver comprehensive documentation with proper testing and certification.

The best competitive advantage isn’t a lower hourly rate-it’s a reputation for accuracy. When you consistently quote within 5 percent of actual cost and deliver on time, customers stop shopping on price and start requesting you by name. This means conducting proper site surveys, building historical data from completed projects, and using that data to quote future work with confidence. Bundling value-added services into fixed pricing rather than itemizing everything separately also positions you to maintain healthy margins while competitors race to the bottom on hourly rates.

Reliable network infrastructure requires more than just cable installation-it requires ongoing support and optimization. Our managed IT and networking solutions help businesses maintain peak performance after installation is complete, ensuring your customers get lasting value from the infrastructure you build.