Finance firms face unique challenges when it comes to IT management. At Clouddle, we understand the critical role that technology plays in the financial sector.

Choosing the right managed IT services for finance companies can make or break their operations. This guide will help you navigate the complex landscape of managed IT services in finance, ensuring you select a provider that meets your specific needs and regulatory requirements.

Key Factors in Choosing Managed IT Services for Finance

When selecting managed IT services for finance firms, several critical factors come into play. Let’s explore the essential considerations that will guide your decision-making process.

Regulatory Compliance and Data Security

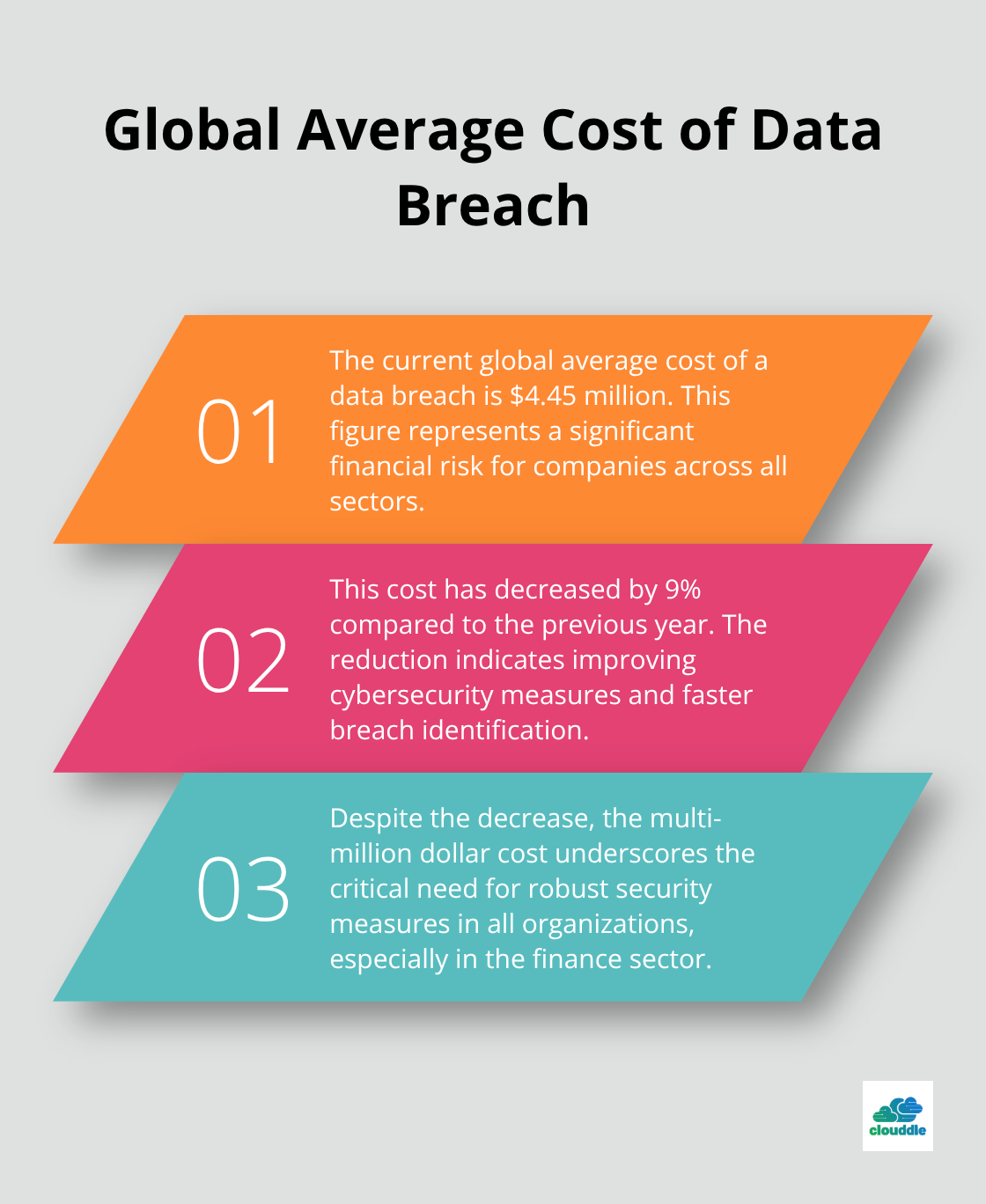

In the finance sector, compliance isn’t optional-it’s mandatory. The global average cost of a data breach is $4.45 million, a 9% decrease over last year-driven by faster identification and containment. This underscores the critical need for robust security measures.

Your managed IT service provider must understand regulations like SOX, GLBA, and PCI DSS. They should offer solutions that meet and exceed these standards. Look for providers who implement encryption, maintain secure firewalls, and provide intrusion detection systems (IDS) as mandated by PCI DSS.

Scalability and Industry-Specific Expertise

Financial firms need IT services that grow with them. Your chosen provider should offer flexible solutions that adapt to your changing needs. This scalability is crucial for maintaining operational efficiency.

Industry-specific expertise is non-negotiable. A provider with experience in the financial sector will understand your unique challenges, from complex trading systems to secure client portals. They should provide case studies and references from other financial institutions they’ve served successfully.

Service Level Agreements and Support

Clear, comprehensive Service Level Agreements (SLAs) form the backbone of a successful IT partnership. These agreements should outline response times, uptime guarantees, and the scope of services provided. For financial firms, 24/7 support often proves necessary to ensure operational integrity.

When evaluating SLAs, pay close attention to the provider’s track record in meeting their commitments. Ask about their average response times and resolution rates. In finance, every minute of downtime can translate to significant losses.

Technology Stack and Partnerships

The technology stack your managed IT service provider uses can significantly impact your operations. Look for providers who partner with leading technology companies and use cutting-edge solutions. This ensures you’ll have access to the latest advancements in cybersecurity, cloud computing, and data management.

Providers should offer a mix of proprietary tools and industry-standard solutions. This combination allows for customization to your specific needs while maintaining compatibility with widely-used financial software.

Cost-Effectiveness and ROI

While cost shouldn’t be the only factor, it’s an important consideration. Evaluate the total cost of ownership (TCO) for the managed IT services. This includes not just the monthly or annual fees, but also potential savings from improved efficiency, reduced downtime, and avoided compliance penalties.

Ask potential providers about their pricing models (per user, per device, or flat rate) and how they align with your budget and growth projections. A good managed IT service should provide clear ROI through enhanced security, improved productivity, and streamlined operations.

As we move forward, let’s examine the specific IT services that are essential for finance firms in today’s digital landscape.

Essential IT Services for Finance Firms

Cybersecurity: Your First Line of Defense

Cybersecurity stands as the cornerstone of IT services in finance. Cybersecurity teams at financial firms aim to ensure that data is encrypted, securely stored, and protected. Implement multi-factor authentication (MFA) across all systems to reduce the risk of breaches. Deploy next-generation firewalls and intrusion detection systems to fortify your network perimeter.

Conduct regular penetration testing at least quarterly to identify vulnerabilities before hackers do.

Cloud Computing: Flexibility Meets Security

Cloud computing offers unparalleled flexibility and scalability for finance firms. The advantages include instant scalability, improved resiliency, and cost benefits. However, downsides remain, so consider hybrid cloud solutions to balance flexibility with security needs.

Select cloud providers with financial services expertise. They should offer compliance-ready solutions that adhere to regulations like SOX and GLBA out of the box. Demand end-to-end encryption for data in transit and at rest to create a safety net against data breaches.

Disaster Recovery: Your Business Continuity Lifeline

In finance, downtime translates to lost revenue and damaged reputation. A robust disaster recovery plan serves as your insurance policy against the unexpected. Try to achieve a Recovery Time Objective (RTO) of less than four hours for critical systems.

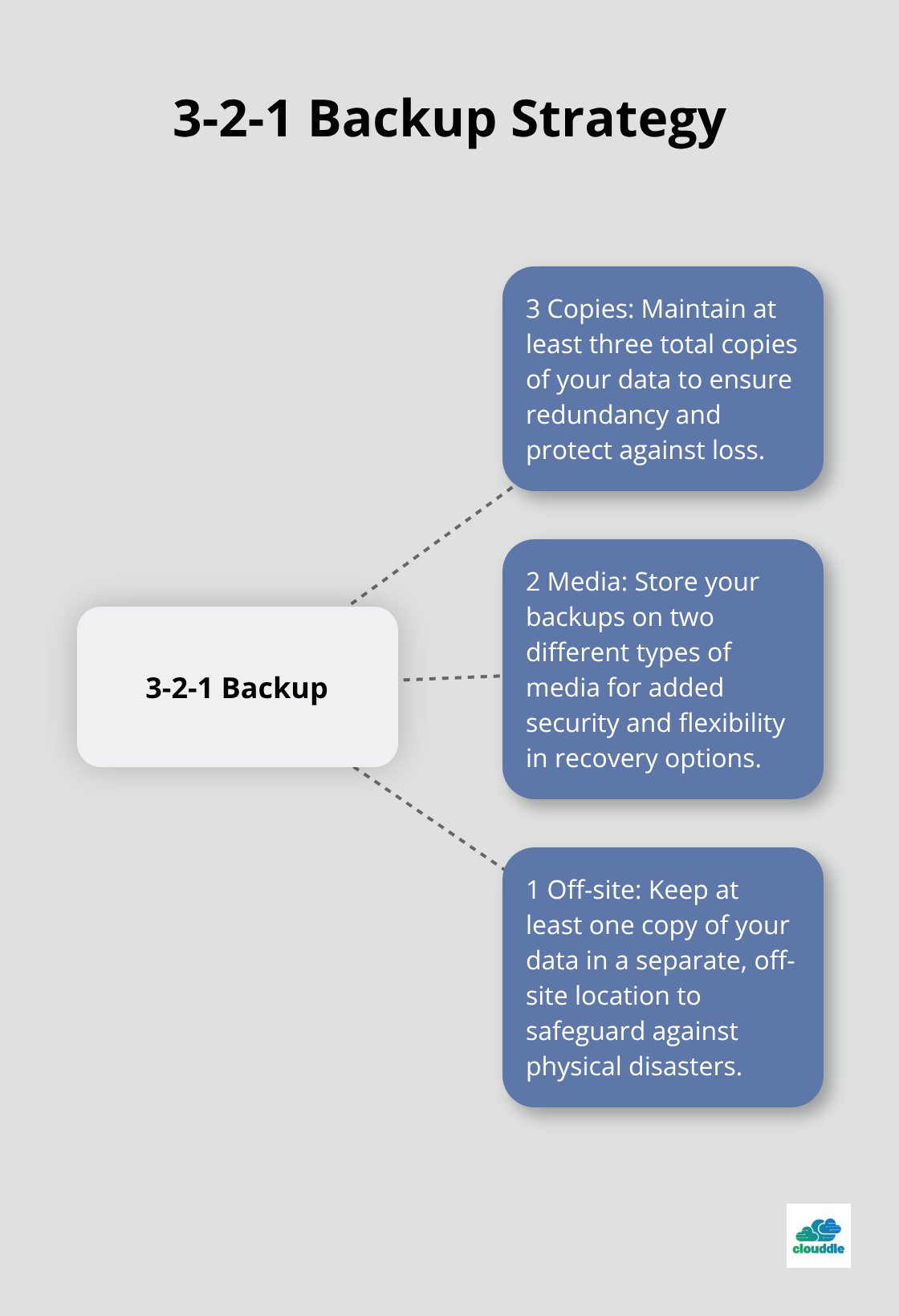

Implement a 3-2-1 backup strategy: three copies of your data, on two different media, with one copy off-site. Test your disaster recovery plan quarterly through simulations to reveal gaps that theoretical plans often miss.

Network Infrastructure: The Backbone of Operations

Your network infrastructure forms the foundation for all other IT services. Invest in high-performance, low-latency networks capable of handling real-time financial transactions.

Use network segmentation to isolate critical financial systems from less secure areas of your network. This approach improves security and aids compliance by limiting access to sensitive data. Set up 24/7 network monitoring with advanced analytics tools to detect anomalies in real-time, enabling swift responses to potential threats.

As we move forward, it’s clear that choosing the right managed IT service provider is critical for implementing these essential services effectively. Let’s explore how to evaluate potential partners to ensure they meet the unique needs of your finance firm.

How to Evaluate Managed IT Service Providers

Assess Financial Industry Expertise

Start your evaluation by scrutinizing the provider’s experience in the financial sector. Look for providers who can meet stringent financial industry regulations with automated compliance controls and comprehensive audit capabilities. They should demonstrate a deep understanding of regulatory requirements and explain how their services ensure compliance with these standards.

Examine Technology Stack and Partnerships

A provider’s technology stack can determine their ability to serve your needs effectively. Ask about their partnerships with leading technology vendors. Do they work with industry giants like Cisco, Microsoft, or IBM? These partnerships often indicate access to cutting-edge solutions and support.

Inquire about their approach to emerging technologies like AI and blockchain in financial services. A forward-thinking provider should have a clear strategy for incorporating these innovations into their offerings.

Don’t just take their word for it. Request a demo of their key systems and tools. This hands-on experience will give you a better feel for their technological capabilities and user interface.

Conduct Thorough Due Diligence

While glossy marketing materials can impress, nothing beats first-hand information. Reach out to their existing clients in the finance sector. Ask pointed questions about the provider’s performance, responsiveness, and ability to handle crisis situations.

Some key questions to ask:

- How quickly does the provider respond to critical issues?

- Have they ever failed to meet an SLA commitment?

- How proactive are they in suggesting improvements to your IT infrastructure?

If possible, arrange an on-site visit to the provider’s operations center. This will give you insight into their work culture, security measures, and the caliber of their staff. Pay attention to how they handle sensitive client data and their disaster recovery facilities.

During your visit, interview key team members who would be responsible for your account. Assess their knowledge, communication skills, and cultural fit with your organization (these are the people you’ll work with closely, so personal rapport matters).

Evaluate Financial Stability

Don’t neglect the financials. Request the provider’s audited financial statements for the past few years. A financially stable provider is more likely to be a reliable long-term partner. Look for consistent growth, healthy profit margins, and low debt levels.

Try to analyze their client retention rates and the average length of their client relationships. These metrics can provide valuable insights into the provider’s reliability and customer satisfaction levels.

Consider Scalability and Future-Proofing

The IT needs of finance firms often evolve rapidly. Ensure the provider can scale their services to match your growth. Ask about their capacity to handle increased data volumes, user numbers, and new technologies (this flexibility will be essential as your firm expands).

Discuss their roadmap for future service offerings. A provider invested in continuous improvement and innovation will help keep your IT infrastructure ahead of the curve.

Final Thoughts

Selecting the right managed IT services for finance firms will significantly impact your organization’s success. The factors we explored should guide your evaluation process. Your chosen provider must meet your current needs and anticipate future challenges in the evolving financial landscape.

Your IT strategy must align with your business goals. The ideal managed IT service provider will act as a strategic partner, offering solutions that drive efficiency, enhance security, and support your growth objectives. This alignment will transform your IT infrastructure into a competitive advantage.

We at Clouddle understand the unique challenges finance firms face in managing their IT infrastructure. Our managed IT services for finance provide robust security, ensure regulatory compliance, and deliver the scalability needed in the fast-paced financial world. We offer 24/7 support and flexible contracts that streamline operations and drive growth.