To figure out your Net Operating Income (NOI), you simply take your total operating expenses and subtract them from your gross operating income. This calculation is powerful because it shows you the pure earning potential of an asset before things like loan payments and taxes muddy the waters. It's the cleanest way to see an asset's core profitability.

What Net Operating Income Really Means

Before we jump into the formula, let's get a feel for what NOI is telling us. I like to think of it as the "take-home pay" from a property's day-to-day operations. It's the number that cuts through the noise and reveals if a venture is actually as profitable as it looks on paper.

Unlike the bottom-line net income, which gets bogged down by debt payments and income taxes, NOI focuses squarely on the performance of the asset itself. This is a crucial distinction. It lets you make a true apples-to-apples comparison between different investment opportunities, no matter how they’re financed or taxed.

By focusing only on revenue and operational costs, NOI gives you a clear, unbiased picture of an asset’s financial health and efficiency. It answers one fundamental question: Is this operation generating enough money to sustain itself and produce a profit?

Why This Metric Matters

Getting a handle on NOI is a non-negotiable skill for any business owner or real estate investor. It’s the universal language of profitability. In commercial real estate, it's the gold standard for measuring a property's income-generating power because it strips out the influence of financing and taxes. That's why you'll see it used as a benchmark in real estate markets all over the world.

For a business owner, it's your best tool for spotting operational leaks. Your revenue might be soaring, but if your operating expenses—think utilities, maintenance, or security—are creeping up, your NOI will take a hit. A practical first step is to analyze these components, like digging into your business security system cost.

At the end of the day, a healthy NOI proves that your asset isn't just running; it's running well.

Quick Guide to NOI Components

To nail the NOI calculation, you need to be crystal clear about which numbers go in and which stay out. This table breaks it down for you.

| Component Type | What to Include in Your Calculation | What to Exclude from Your Calculation |

|---|---|---|

| Income | Rental income, parking fees, laundry machine revenue, and any other income generated directly from the property's daily operations. | One-time sales of assets (like a piece of equipment), loan proceeds. |

| Expenses | Property taxes, insurance, maintenance & repairs, utilities, property management fees, regular janitorial services, landscaping. | Mortgage payments (principal and interest), income taxes, capital expenditures (like a new roof), depreciation, amortization. |

Remember, the goal is to isolate the operational performance. Anything related to financing, taxes, or major one-off capital improvements should be set aside for this specific calculation.

Breaking Down the NOI Formula

On paper, the formula for Net Operating Income seems simple enough: Gross Operating Income minus Operating Expenses. But the real skill lies in knowing exactly what to count on each side of that equation. Getting this right is what separates a fuzzy guess from a truly accurate financial snapshot.

Think of it like putting together a puzzle. Every piece of income and every single expense needs to be put in its proper place before you can see the clear picture of how your asset is actually performing.

What Really Goes into Gross Operating Income?

Your Gross Operating Income (GOI) is the total of all the money a property brings in from its normal, day-to-day business. This is more than just rent—it’s about capturing every single dollar the property generates before you start paying the bills.

For a typical rental property, this would include:

- Rental Income: The main event, of course. This is the base rent you collect from tenants.

- Ancillary Fees: This is where people often miss things. We're talking about extra income from parking spots, laundry machines, pet fees, or rented-out storage units.

Forgetting these "extra" income streams is a classic mistake that will always make your property look less profitable than it is. You have to be meticulous and account for every revenue-generating activity.

Pinpointing Your True Operating Expenses

This is where things can get a little tricky. Operating Expenses (OpEx) are simply the costs required to keep the lights on and the property running smoothly. These are the predictable, everyday expenses that come with owning and maintaining the asset.

The most important rule to remember is that operating expenses are costs incurred to maintain the property's current condition and operations, not to improve it or pay off its financing.

So, what makes the cut?

- Property Taxes & Insurance: The unavoidable costs of ownership.

- Utilities: Think water, sewer, trash, and electricity for any common areas.

- Maintenance & Repairs: All the routine stuff, from fixing a leaky faucet to landscaping and pest control.

- Management Fees: What you pay a property manager to handle the day-to-day.

While NOI is a real estate staple, it's used all over the business world. A software company with $300,000 in quarterly gross income and $220,000 in operating expenses like payroll and marketing would have an NOI of $80,000. This number tells them how profitable their core business is, separate from financing or big investments. You can find more about financial metrics like this over at Hibob.com.

What absolutely does not count as an operating expense? Your mortgage payment, a major capital expense like a new roof, and depreciation. Those costs are related to financing or improving the asset, not operating it.

How to Calculate NOI in the Real World

The formulas are a great start, but let's be honest—the real learning happens when you start plugging in actual numbers. Seeing how NOI plays out in a practical scenario is the best way to get a feel for it. Let's walk through a common example: a real estate investment.

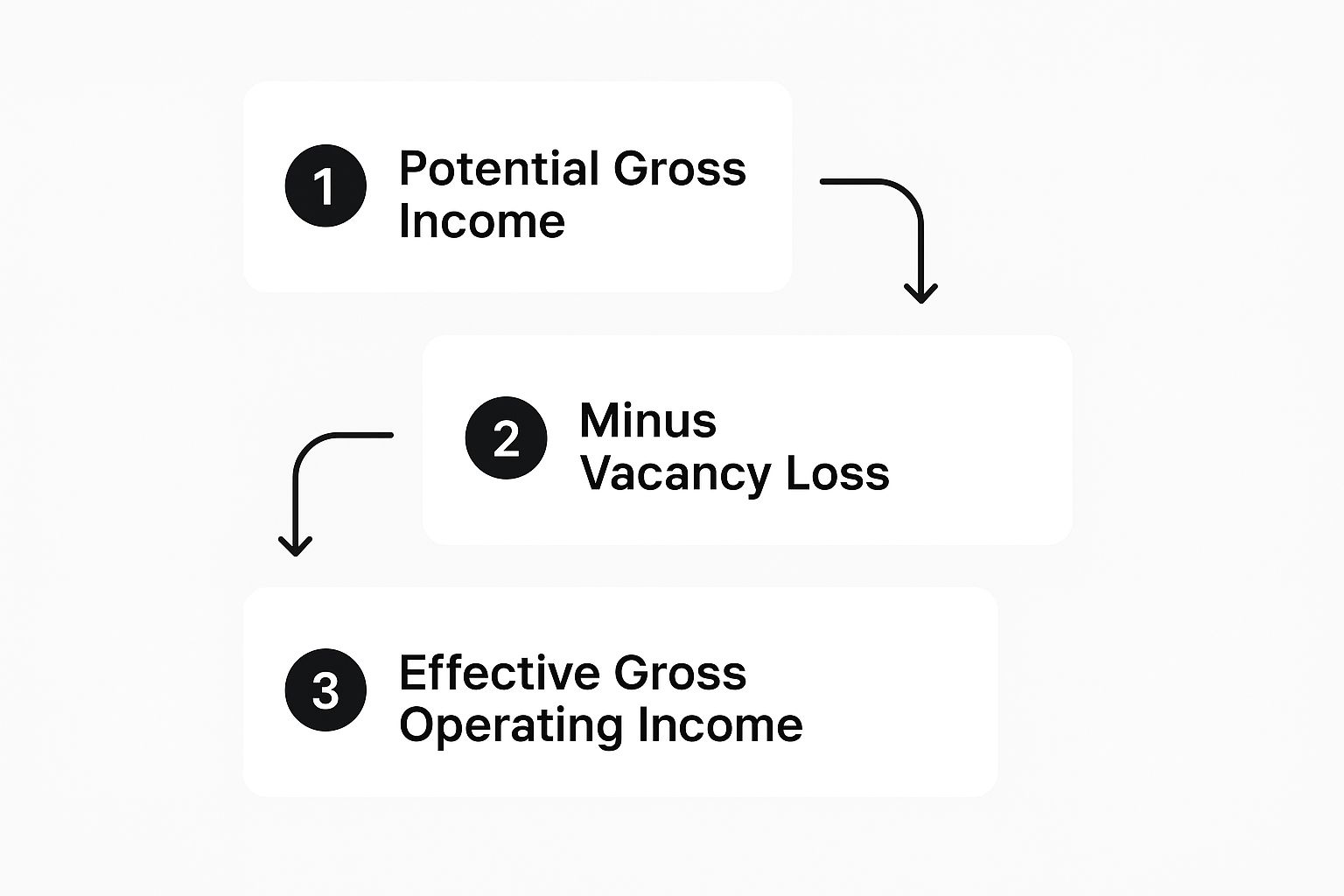

Imagine you're eyeing a small, 10-unit apartment building. Each apartment rents for $1,500 a month. On paper, that's a potential gross income of $180,000 for the year. But we know it’s rare to have 100% occupancy.

A smart investor always accounts for vacancies. If you anticipate a conservative 5% vacancy rate, that means you need to subtract $9,000 from your potential income. Right away, your realistic, effective gross income (EGI) drops to $171,000.

This simple adjustment is the first step toward getting an honest picture of a property's performance.

Starting with potential income and dialing it back to an effective, achievable number is what separates a grounded analysis from an overly optimistic one.

Tallying the Operating Expenses

Now for the other side of the ledger: the costs. Every property has expenses that are essential to keep it running smoothly and tenants happy. Using a good cost estimation calculator can help you get a handle on these, but for our 10-unit building, let's assume the annual costs look something like this:

- Property Taxes: $20,000

- Insurance: $8,000

- Maintenance & Repairs: $12,000

- Property Management Fees (8% of EGI): $13,680

- Utilities (for common areas): $6,000

Add all that up, and your Total Operating Expenses land at $59,680.

Now, we just subtract those expenses from our $171,000 effective gross income. The result? A final NOI of $111,320. Keeping a tight rein on these costs is critical, which is why a thorough property management software comparison is often a worthwhile exercise to find tools that can help.

By subtracting all operational costs from the actual income collected, you arrive at the true measure of the property's profitability before any financing is considered. This $111,320 figure is what you'd use to compare this investment against others.

This same logic holds true for any business, not just real estate. Think about a local coffee shop that brings in $27,000 a month in sales. Once you subtract its $18,000 in monthly operating expenses—things like staff wages, coffee beans, milk, and utilities—its NOI comes out to $9,000. As you can see, the core concept is identical, no matter the industry.

Common Mistakes When Calculating NOI

Knowing the NOI formula is just the start. The real skill is avoiding the common pitfalls that can completely throw off your numbers, leading to a disastrous investment decision. I've seen even seasoned pros make these simple mistakes when they're in a hurry.

One of the biggest blunders is mixing up capital expenditures (CapEx) with operating expenses. They aren't the same thing, not by a long shot. Replacing an entire roof is a major capital improvement, not a routine repair. If you mistakenly lump that into your operating expenses, your NOI will look artificially low, and you might pass on a great deal.

Mistaking Potential for Reality

Here's another classic error: using Potential Gross Income instead of Effective Gross Income. It's easy to get starry-eyed about what a property could make. A building might have the potential to bring in $100,000 a year, but that assumes every unit is filled and every tenant pays on time, every single month. That's a fantasy.

Vacancies and credit losses are just part of the business. You have to subtract those losses to get a real-world picture of the income you can actually expect to deposit in the bank. Projecting your numbers based on a 100% occupancy rate is setting yourself up for failure.

The single biggest, most fundamental mistake I see is including financing costs. Let me be clear: your loan principal and interest payments have nothing to do with NOI. NOI is all about the property's performance before debt. Tossing mortgage payments in there completely defeats the purpose of the metric.

Other Frequent Errors to Sidestep

To keep your analysis sharp and accurate, you have to stay vigilant about a few other common oversights.

- Forgetting Ancillary Income: It's so easy to focus on the big rent checks and forget about the smaller revenue streams. Things like parking fees, laundry machine income, or even pet fees add up. Every dollar that comes from the property's operations belongs in your calculation.

- Ignoring Property Management Fees: This one gets missed all the time, especially by self-managers. Even if you're doing the work yourself, you should always factor in a standard management fee—usually 8-10% of effective gross income. Why? Because it gives you a true sense of the property's profitability and prepares you for the day you might want to hire someone.

- Improperly Classifying Expenses: Getting lazy with your bookkeeping can cost you. Was that a one-off improvement or a recurring repair? The difference matters. Be disciplined and stick to the definition of a recurring, operational cost.

Steer clear of these common blunders, and your NOI calculation will transform from a simple number into a powerful, reliable tool for judging a property's true financial health.

Putting Your NOI Number to Work

Figuring out your Net Operating Income is a great starting point, but the real magic happens when you actually put that number to use. An NOI calculation isn't just some figure to plug into a spreadsheet; it's a powerful diagnostic tool that seasoned investors and sharp business owners lean on to make smarter, more profitable decisions. It elevates your analysis from basic accounting to true strategic financial planning.

This single metric drives several of the most critical performance indicators in real estate and business. When you track your NOI over time—whether it's quarter-over-quarter or year-over-year—you can catch operational hiccups before they turn into major problems. A dipping NOI, especially when revenue is flat, is a massive red flag that your operating expenses are creeping up. That insight is your cue to take action, perhaps by exploring ways to reduce operational costs and protect your profit margins.

Fueling Key Investment Metrics

One of the most immediate uses for NOI is calculating the Capitalization Rate, or Cap Rate. The formula is refreshingly simple: NOI / Property Value = Cap Rate. This gives you a quick, clean way to estimate an investment's potential return and compare different properties on a level playing field.

Let’s say you’re looking at a property with an NOI of $100,000 and it’s on the market for $1,250,000. Its Cap Rate would be 8%. This single percentage is a powerful benchmark that tells you if the asking price is reasonable for its earning potential, especially when you compare it to other assets in the same market.

Lenders are also obsessed with your NOI. They use it to calculate the Debt Service Coverage Ratio (DSCR), which is their way of measuring your ability to comfortably make your mortgage payments. To put it bluntly, a healthy NOI is non-negotiable if you want to secure good financing terms.

Making Strategic Decisions with NOI

Beyond valuations and loan applications, NOI is your guide for making critical operational moves. A strong, growing NOI might give you the confidence to refinance for a better rate or even expand your portfolio. On the flip side, a flat or declining NOI could be a signal that it’s time to re-evaluate your property management, marketing, or overall market position.

Here are a few ways to put it into practice:

- Performance Benchmarking: How does your property's NOI stack up against similar ones in the area? Comparing them can quickly reveal if you're overspending on things like maintenance or utilities.

- Budget Forecasting: Your historical NOI data is the best foundation for building realistic and accurate budgets for the next year. No more guessing.

- Investment Analysis: When it's time to sell, a history of consistent, stable NOI makes your property far more attractive to potential buyers. It’s proof of a well-run asset.

At the end of the day, your NOI is more than just a calculation. Think of it as a compass pointing you toward financial health, operational efficiency, and smarter growth.

Common Questions About Net Operating Income

As you start working more with NOI, a few questions almost always come up. Let's tackle them head-on to clear up any confusion and make sure you're using this metric effectively.

Is Net Operating Income the Same Thing as Profit?

Not at all, and it's a critical difference. Think of NOI as the pure, unvarnished earning power of an asset before you account for any financing or taxes. It tells you how well the operation itself is performing.

Net income, or profit, is the final number on your statement after every single expense is paid, including things like loan interest and income taxes. NOI gives you a cleaner look at an asset's day-to-day financial health, separate from how it was financed.

Can Net Operating Income Be Negative?

You bet it can. A negative NOI is a major red flag, telling you that an asset's operating expenses are actually higher than the revenue it's bringing in.

This means the property or business is losing money from its core operations alone, even before a single dollar goes toward debt payments.

A negative NOI is an urgent signal that something is fundamentally broken. It means you need to immediately dig into your revenue streams or your cost controls to figure out where the money is bleeding out.

How Does Depreciation Fit into the NOI Calculation?

It doesn't. Depreciation is a non-cash expense, so it's intentionally left out of the NOI formula. While it’s essential for figuring out your taxes and arriving at net income, it isn't a real cash expense tied to daily operations.

NOI is all about the actual cash flow an asset generates. Keeping depreciation out of the equation gives you a much clearer picture of its immediate financial performance. For a deeper dive, this complete guide on Net Operating Income offers more examples and perspectives to round out your understanding.

At Clouddle Inc, we build technology solutions that help you boost your NOI by tackling operational expenses head-on. Our integrated security, networking, and cloud services are designed to cut costs and improve efficiency, strengthening your bottom line. See how we can help at https://www.clouddle.com.