When it comes to boosting your property's Net Operating Income (NOI), the game plan really comes down to two simple things: make more money and spend less money. The idea is straightforward, but making it happen requires a sharp, deliberate strategy. You need a smart mix of effective leasing, tight cost control, and value-adding improvements to really move the needle.

Let's walk through a practical playbook for getting it done.

Your Blueprint for Higher Net Operating Income

Think of NOI as the pulse of your real estate investment. It’s what’s left over from your property's total income after you’ve covered all the necessary operating expenses—but before you factor in things like mortgage payments or income taxes. A healthier NOI means a more profitable, and ultimately more valuable, asset.

This isn't just about theory. It’s about taking real, tangible steps that show up on your balance sheet. The secret is to attack the problem from multiple angles, not just banking on one magic-bullet tactic.

The Two Sides of the NOI Equation

To really get a grip on growing your NOI, you have to master both sides of the financial coin. On one side, you have revenue generation, which is about so much more than just cashing rent checks. On the other, you have disciplined expense management—and that’s about spending smarter, not just slashing budgets.

A well-rounded strategy hits both of these pillars at the same time:

- Growing Your Revenue: This means pushing for optimal rental rates, keeping vacancies to an absolute minimum, and getting creative with new income streams.

- Optimizing Your Expenses: Here, the focus is on reining in utility costs, hammering out better deals with vendors, and leaning into preventative maintenance to sidestep those budget-busting emergency repairs.

To help visualize how these pieces fit together, here's a quick breakdown of the core strategies.

Table: Core Pillars of NOI Growth

This table summarizes the primary strategies for increasing Net Operating Income, outlining the goal and key actions for each pillar discussed in the article.

| Strategy Pillar | Primary Goal | Key Actions |

|---|---|---|

| Revenue Growth | Maximize all potential income sources from the property. | Optimize rent pricing, reduce vacancy rates, add ancillary services (e.g., parking, storage). |

| Cost Optimization | Minimize all necessary operating expenditures without sacrificing quality. | Lower utility consumption, renegotiate vendor contracts, implement preventative maintenance. |

| Value-Add Improvements | Increase the property's attractiveness and rental value through strategic upgrades. | Renovate units, enhance common areas, add modern amenities (e.g., smart tech, fitness centers). |

By systematically addressing each of these areas, you create a powerful, compounding effect on your property's financial performance.

Real-World Performance and Strategy

Even when the economy gets rocky, a focused strategy pays off. Take a look at the US equity REIT sector, where the median NOI growth recently slowed to 2.9%. Despite that, healthcare REITs managed to pull off an impressive 7.7% growth. How? They zeroed in on increasing occupancy and bumping up the revenue per occupied room. You can dig into more of these US REIT performance trends to see just how much a sector-specific strategy can matter.

This data really drives home a crucial point: your tactics have to be tailored to your specific property type and the market you're in.

The best plans for NOI growth are never one-size-fits-all. They are custom blueprints built on a deep understanding of a property’s unique strengths, weaknesses, and market opportunities. The goal is to build a resilient asset that thrives no matter what the economic cycle throws at it.

Maximizing Revenue with Smart Leasing Strategies

Driving revenue is about so much more than just filling empty units and cashing checks. If you really want to move the needle on your NOI, you need to get sophisticated with your leasing strategies. It’s about squeezing every last drop of potential income from your property. This means you have to ditch the old "set it and forget it" approach to rent and get active with a data-informed game plan.

The single biggest shift you can make is embracing dynamic pricing. Forget charging a flat rate for every two-bedroom apartment. This model adjusts rent based on what’s happening in the market right now and what makes each unit unique. For example, that corner unit with the great view? It can command a premium. The one right next to the newly renovated gym? That’s worth more, too. You can also flex rents with the seasons—pushing them higher during peak moving season and offering a slight discount in the slower winter months to keep occupancy strong.

When you dig into the market data, you start seeing these small but powerful opportunities. A 5% bump in occupancy or a small lift in the average rent might not sound like much, but it drops straight to your bottom line.

Moving Beyond Simple Occupancy

Getting units filled quickly is one thing, but filling them with great, long-term tenants is what really protects your revenue stream. Tenant turnover costs are a silent killer of your NOI—think marketing expenses, cleaning, repairs, and of course, the lost rent during the vacancy. This is why making tenant retention a priority is one of the smartest revenue-generating moves you can make.

A deep dive into revenue optimization is essential for anyone serious about boosting their property's income. As detailed in this Guide to Revenue Optimization for Rentals, it’s a strategy that balances smart pricing with genuine tenant satisfaction. Things like proactive communication, fun community events, and super-responsive maintenance aren't just perks; they're your best retention tools.

Think of it this way: every lease you renew is a marketing campaign you didn't have to run and a vacancy you didn't have to fill. The ROI on keeping a good tenant is almost always higher than the cost of finding a new one.

Focusing on the tenant experience builds a stable, predictable income stream—the very foundation of a healthy NOI. For more on this, our guide on proven tenant retention strategies is packed with actionable ideas you can start using today.

Leveraging Data and Marketing

In today’s market, you can't fly blind. Your leasing strategy needs to be powered by modern tools. Digital marketing and data analytics let you find and attract your ideal tenants with incredible efficiency. This isn't about casting a wide net anymore; it's all about precision.

Here are a few ways to put this into practice:

- Targeted Digital Ads: Use platforms that let you zero in on potential tenants based on their demographics, income, and even interests that match your property’s amenities (like proximity to hiking trails or a pet-friendly policy).

- Virtual Tours and Pro Photos: A stunning online presence is non-negotiable. Let prospects fall in love with a unit before they even step inside. This dramatically shortens the time it takes to get a lease signed.

- Data-Driven Decisions: Your property management software is a goldmine of information. Track your lead sources, conversion rates, and how long units sit vacant. This data tells you exactly which marketing channels are working and where to put your money for the best return.

When you combine smart pricing, a relentless focus on retention, and data-backed marketing, you create a powerful revenue engine. This comprehensive approach means you’re no longer just reacting to the market—you're actively shaping your financial future and building a foundation for sustainable NOI growth.

Reducing Expenses Without Sacrificing Quality

While boosting revenue gets all the attention, the other side of the NOI equation—cost control—is where the best operators really shine. This isn't about slashing budgets in ways that hurt the tenant experience or diminish the property's value. It's about smart, surgical expense management that builds a healthier bottom line.

True financial discipline means finding ways to manage your expenses more effectively than your revenue grows, especially in an inflationary environment. We've seen property managers in Europe, for instance, achieve significant NOI bumps from energy-efficient retrofits, which often cut utility bills by a solid 10–15%. The global trends in wages and costs, which you can explore in Statista’s in-depth data, only make this more critical.

The whole game is finding efficiencies that either maintain or, even better, improve the resident experience.

Target High-Impact Utility Savings

Utilities are one of the biggest and most volatile line items on any operating statement. That makes them a prime target for optimization. The trick is to invest in smart tech that delivers predictable, long-term savings.

Even simple upgrades can produce an impressive ROI.

- LED Lighting Retrofits: This is low-hanging fruit. Swapping out old incandescent or fluorescent bulbs across your property can slash your lighting-related energy use by over 75%. The payback period is often just a couple of years.

- Smart Thermostats and HVAC Systems: Installing smart thermostats in common areas and vacant units stops you from heating or cooling empty space. It’s an easy win. And when it’s time to replace an HVAC unit, today’s models are leagues ahead of older systems in efficiency.

- Water Conservation Fixtures: For multifamily properties, this is a no-brainer. Installing low-flow toilets, showerheads, and faucet aerators is cheap and can drastically cut your water and sewer bills.

These aren't just expenses; they're investments in operational efficiency that pay you back by directly increasing your NOI.

Renegotiate and Benchmark Vendor Contracts

Never let your vendor contracts for landscaping, cleaning, or security run on autopilot. If you’re not reviewing them regularly, you're almost certainly leaving money on the table.

Make it a yearly practice to get at least three competitive quotes for each major service. Use this information not just to chase the lowest price, but to benchmark your current provider. Armed with real data, you have serious leverage to renegotiate.

A good vendor relationship is valuable, but it shouldn't come at a premium. A quick call to your long-term landscaper letting them know you have a competitive quote can often result in them matching the price to keep your business. You save money without the headache of switching.

This proactive approach keeps everyone honest and ensures your money is working as hard as you do. To get more tactical on this, our guide on how to reduce operational costs goes into even greater detail.

Embrace Proactive Maintenance

Reactive maintenance—waiting for something to break before you fix it—is a budget killer. An emergency call to a plumber on a holiday weekend will always cost you more in dollars and tenant frustration than a planned repair.

A preventative maintenance schedule is your best defense against these costly surprises. This means regularly inspecting and servicing your property’s critical systems—roofs, boilers, elevators, you name it. When you catch small issues early, you prevent them from becoming catastrophic failures and you extend the life of your most expensive assets.

Modern property management software can be a game-changer here. By automating maintenance requests, tracking work orders, and scheduling routine inspections, you cut down on administrative drag. It frees up your team to focus on improving the property instead of just putting out fires.

Tap Into Hidden Profits with Ancillary Income

If you think your property's revenue potential stops at the monthly rent check, you're leaving money on the table. The real secret to a healthier bottom line lies in ancillary income—those often-overlooked profit centers that can diversify your revenue and make your investment far more resilient.

These are the value-added services and amenities that modern tenants are more than happy to pay for. It's all about monetizing underused spaces and offering conveniences that fit today's lifestyles. This strategy directly fuels your efforts to increase NOI by layering high-margin revenue on top of your core rental income.

Start with the Classics: Traditional Ancillary Revenue

Some of the most dependable ancillary income streams are the ones that have been around for a while. They're straightforward to implement and tap into consistent tenant demand, making them a perfect place to start.

-

Premium Parking and Storage: Do you have covered parking spots, larger corner spaces, or secure storage units? Don't just give them away. Charging a monthly fee for these premium assets is one of the easiest wins out there. You're generating income from property you already own.

-

Upgraded Laundry Facilities: Ditching old, coin-operated machines for modern, card-based systems does more than just make residents' lives easier. These systems offer better revenue tracking and allow for tiered pricing on larger or high-efficiency machines, creating a small but incredibly steady income stream.

This isn't just a local trend; it's a globally recognized way to boost financial performance. In fact, data shows that properties offering at least three such services can see their NOI jump by 10–15% on average compared to properties that don't. You can dig deeper into how these value-add strategies work in McKinsey’s analysis of global economic profit.

Get Creative with Modern Amenities and Partnerships

Once you have the basics down, you can move on to more innovative services that not only generate profit but also attract a higher caliber of tenant. You have to start thinking like a service provider, not just a landlord.

Have you considered installing EV charging stations? With the rise of electric vehicles, on-site charging is a massive differentiator that appeals directly to higher-income residents. By setting up a simple pay-per-use model, you create a brand-new, utility-based revenue stream that meets a growing market demand head-on.

Another smart move is renting out your common areas. That beautiful clubhouse, rooftop deck, or business center can be booked by residents for private parties or meetings, turning these shared spaces into income generators during their downtime.

Think of your property as a platform. You can partner with local businesses—a dry cleaner, a dog walker, a meal-kit service—to offer exclusive deals to your residents. You take a small commission, it costs you nothing, and it adds immense value for your tenants.

Finally, fee-based services like smart package lockers solve a huge pain point for residents while adding to your income. Instead of staff wasting hours sorting packages, an automated system can handle deliveries securely, and residents pay a small fee for the convenience. Each of these strategies adds another layer of revenue, fortifying your property’s financial foundation.

Making Capital Improvements That Pay for Themselves

Smart spending is an investment, not just another expense. When you're looking for ways to boost your NOI, capital improvements (CapEx) can deliver some of the strongest returns, but you have to be strategic. The real trick is knowing the difference between simply maintaining your property and making true value-add upgrades.

Patching a leaky roof is just keeping the lights on. Installing a brand-new, energy-efficient roofing system that slashes your utility bills for the next decade? That's an investment. Your goal should always be to identify projects that either let you command higher rents or permanently drive down your operating costs.

Think about it this way: a modern kitchen renovation with stainless steel appliances and quartz countertops isn't just for looks. It’s a calculated move that can justify a serious rent bump, attracting a better class of tenant and directly increasing your gross income. The same logic applies to replacing an old, wheezing HVAC system—you're not only dodging future repair bills but also lowering energy costs month after month.

Prioritizing Upgrades for Maximum Return

Not all upgrades are created equal. I've seen owners sink a fortune into projects with almost no financial upside. The key is to focus on improvements with a clear, predictable impact on your bottom line. Before you spend a dime, start by analyzing what your target tenants or guests actually want in your specific market.

Here are a few high-impact areas that consistently deliver:

- In-Unit Technology: Things like smart thermostats, keyless entry systems, and built-in USB outlets are quickly moving from "nice-to-have" to "must-have." These relatively small touches can make your units feel modern and far more appealing than the competition.

- Energy Efficiency: Go beyond the HVAC. Think about new windows, better insulation, or even solar panels. These upgrades reduce costs for you and your tenants, which is a powerful selling point.

- Common Area Enhancements: A dated fitness center or a sad-looking resident lounge can drag down your whole property's appeal. Revamping these shared spaces can elevate the entire community and help justify higher rents across the board.

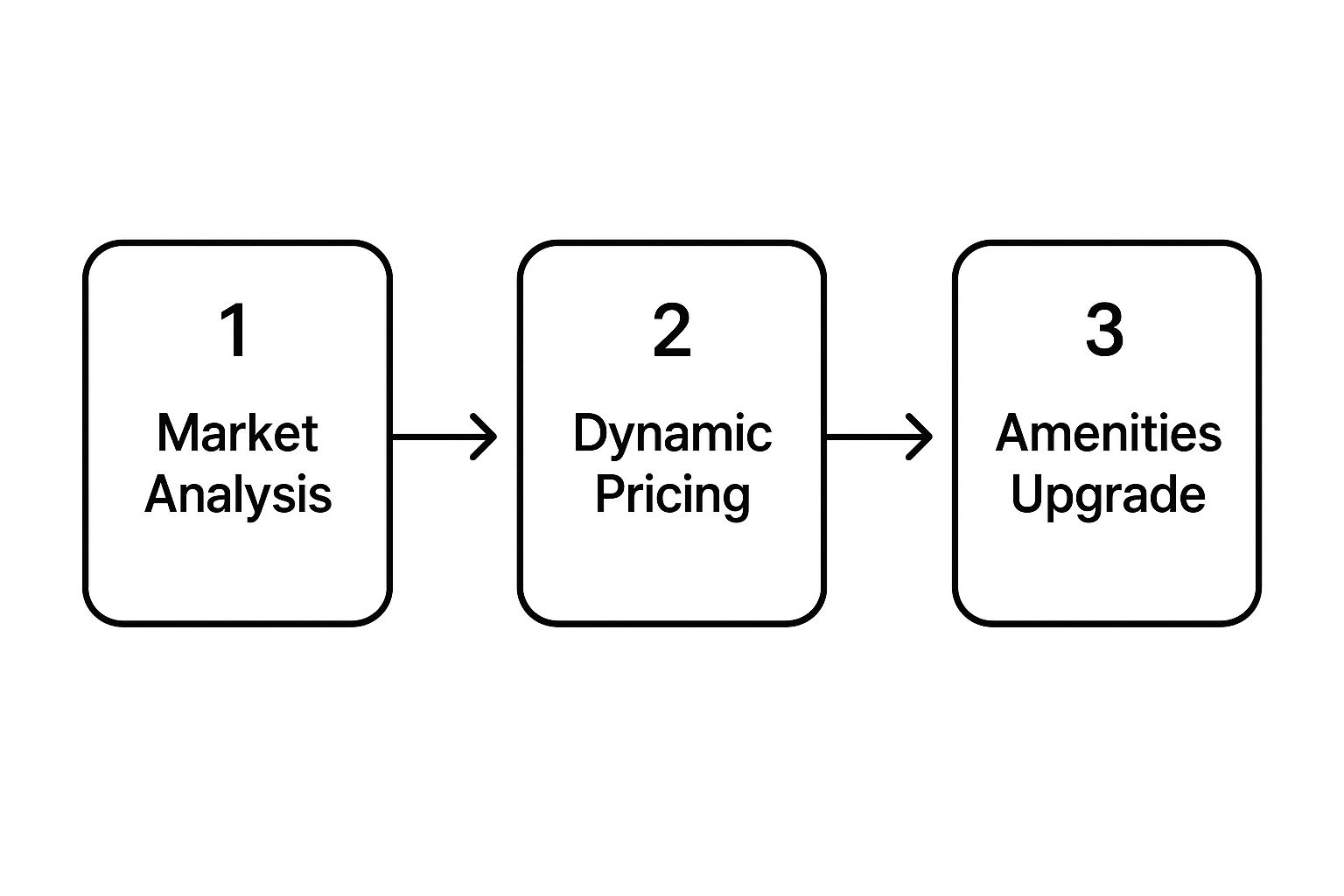

This visual flow breaks down how market insights should drive your decisions, ultimately leading to a healthier NOI.

As you can see, it all starts with understanding what the market demands. Only then can you confidently make changes to your pricing and amenities.

Calculating Your Payback

Before you call the contractor, you absolutely have to run the numbers. It’s all about calculating the return on investment (ROI). A simple way to approach this is to weigh the project's upfront cost against the financial gain you expect, whether it comes from more rent or lower expenses. For a detailed walkthrough, check out our guide on the ROI for properties upgrading with technology.

An upgrade isn’t a good investment unless the math proves it. A $10,000 kitchen renovation that lets you increase rent by $150 per month will pay for itself in under six years. Everything after that is pure profit.

For bigger, more complex projects like a solar installation, the math gets a bit trickier. You'll want to use a dedicated solar return on investment calculator to accurately project the financial benefits. By grounding your decisions in solid data, you can invest with confidence, knowing your improvements will enhance both your property's appeal and its financial performance.

Got Questions About Boosting Your NOI? We've Got Answers.

When you're focused on Net Operating Income, a lot of questions pop up along the way. Let's tackle some of the most common ones I hear from property owners and investors who are serious about improving their bottom line.

What's the Fastest Way to Get a Bump in NOI?

Hands down, the quickest way to move the needle on your NOI is to fill your vacancies. An empty unit is a financial black hole—it's not just failing to produce revenue, it's actively costing you money in utilities, taxes, and upkeep.

Think about it: getting a lease signed, even at the current market rate, provides an instant revenue boost. This is almost always faster and more direct than launching a major renovation project or going through the slow process of renegotiating every single vendor contract. To make this happen, you need a sharp leasing strategy. Maybe that means offering a smart incentive for a quick move-in or just ensuring your units are immaculate and ready to show the second a tenant moves out. A full property is the bedrock of a healthy NOI.

An occupied unit is the foundation of your entire financial model. Every day a unit sits empty, you're not just missing out on rent; you're actively losing money on an underperforming asset.

How Can I Tell if My Operating Expenses Are Out of Line?

The best reality check for your expenses is benchmarking. You have to compare what you're spending to what similar properties in your local market are spending. The go-to metric here is the Operating Expense Ratio (OER), which is simply your total operating expenses divided by your gross operating income.

You'll need to do a little digging to find the typical OER for your specific property type and class (say, a Class A multifamily building versus a suburban office complex) in your city. This info is often in industry reports, or you can get it by networking with other local managers. If your OER is noticeably higher than the average, that's your red flag. It’s time to comb through your expenses line by line, paying extra close attention to the big three: property taxes, insurance, and utilities.

Is It Possible to Raise Rents Without Losing Good Tenants?

Absolutely, but it requires a bit of finesse. The secret to raising rents without a tenant exodus is to be strategic and demonstrate clear, undeniable value. Forget about sudden, steep hikes. The smarter play is to implement smaller, incremental increases that either reflect market trends or are directly tied to tangible improvements you’ve made.

Honest, proactive communication is everything. Give your residents plenty of advance notice and explain the "why" behind the new rate.

- Connect it to Value: Tie the rent increase to a new amenity you’ve added, a freshly updated common area, or better services.

- Provide Context: Briefly show them how your new rates are still fair and competitive for the neighborhood.

- Reward Loyalty: You might offer a slightly smaller increase for tenants who sign their renewal lease early.

When residents feel they're getting their money's worth and are treated like valued community members, they are far more likely to accept a reasonable rent adjustment.

At Clouddle Inc, we provide the managed technology solutions—from smart security to seamless Wi-Fi—that empower property owners to reduce operational costs, add value, and directly increase NOI. Learn how our services can transform your property's financial performance.