The property management life cycle is the entire journey a real estate asset takes, from the moment it's bought to the day it's sold. It's a framework that breaks down the whole process into clear stages, helping property managers make smart decisions to boost value and secure long-term profit. Essentially, it’s what turns a rental property from just a building into a high-performing business.

Understanding the Property Management Life Cycle

Think of the life cycle as a roadmap for your business. A rental property moves through predictable phases—startup, growth, maturity—just like any other company. Each stage brings its own set of challenges and opportunities, demanding specific strategies to protect the asset and keep the returns flowing. If you drop the ball in one phase, you'll create bottlenecks, drive up costs, and ultimately hurt the property's overall value.

A structured approach is what separates the pros from the amateurs. It makes sure every task, whether it's screening a new tenant or scheduling a simple repair, fits into a bigger picture aimed at hitting the owner's financial targets. This system allows managers to get ahead of problems, manage risks, and make decisions based on data, not just gut feelings.

The Five Core Stages

The life cycle is generally broken down into five key stages, each one building on the last. To really succeed and turn a property into a reliable asset, you have to nail every single one.

- Acquisition: This is where it all begins. It's about finding, vetting, and buying a rental property that has real potential for profit.

- Onboarding: With the keys in hand, you now bring the property into your management system. This involves meticulous documentation and getting it ready for tenants.

- Operations: The long haul. This stage covers all the daily grind, from marketing vacant units and managing tenants to collecting rent.

- Maintenance: This is all about preserving the asset. It includes a mix of proactive, reactive, and preventative work to keep the property in top shape and hold its value.

- Disposition: The end game. This final stage is about strategically selling the property to cash in on its appreciated value and maximize the owner's return on investment.

This structured framework isn't just a checklist; it's a continuous cycle of creating value. Doing a great job in the early stages pays off big time when you get to the disposition phase. It's proof that being proactive in management really does pay dividends.

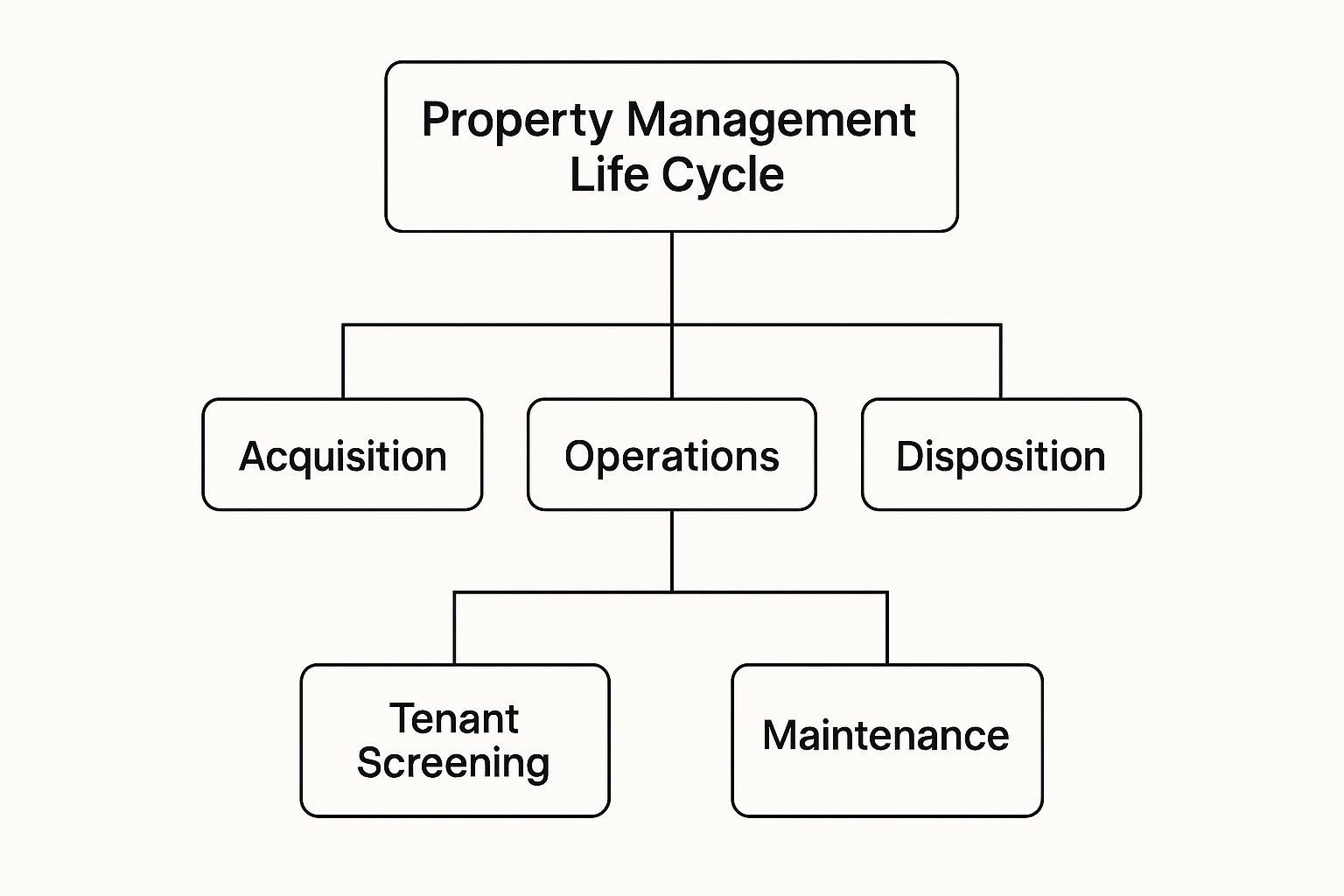

To help you visualize this journey, here’s a quick overview of the main phases and how they connect.

As you can see, the Operations phase is really the heart of the whole process, containing crucial activities like tenant screening and maintenance that keep everything running smoothly. The importance of mastering this cycle is only growing as the industry expands. Projections show the U.S. property management market hitting $81.52 billion in 2025 and climbing to $98.88 billion by 2029, a clear sign of the rising demand for skilled, professional management. You can find more insights on property management market trends over on DoorLoop.

To give you a clearer picture, this table breaks down the five stages at a glance, showing what each one is really about.

The Five Stages of the Property Management Life Cycle

| Stage | Primary Objective | Key Activities |

|---|---|---|

| 1. Acquisition | To purchase a profitable and well-suited investment property. | Market research, financial analysis, due diligence, negotiation, and closing. |

| 2. Onboarding | To integrate the new property into the management portfolio smoothly. | Property inspections, documentation, setting up financial accounts, and initial marketing prep. |

| 3. Operations | To manage the property efficiently for maximum occupancy and cash flow. | Marketing, tenant screening, lease management, rent collection, and tenant relations. |

| 4. Maintenance | To preserve and enhance the property's physical condition and value. | Routine inspections, preventative maintenance schedules, emergency repairs, and capital improvements. |

| 5. Disposition | To sell the asset at the optimal time and price to maximize returns. | Market analysis, property valuation, preparing the property for sale, marketing, and closing the deal. |

Each of these stages requires its own set of skills and strategies, but they all work together to create a successful and profitable investment from start to finish.

Stage One: Acquisition and Onboarding

Every great property investment starts long before the first rent check clears. The Acquisition and Onboarding stage is where you build the entire foundation for future success. It’s not just about finding a building to buy; it's about making a smart, calculated investment and then seamlessly weaving it into your portfolio.

Think of it like a master chef sourcing ingredients. You can't create a five-star meal with wilted vegetables. In the same way, you can't build a profitable portfolio on a shaky property. Finding the right one takes serious research and analysis to make sure it aligns with your financial goals right from the start.

Identifying a Viable Investment

Hunting for the right property isn’t a guessing game—it's a strategic mission. It all begins with a deep dive into market research. You need to get a real feel for local demand, rental trends, and the character of different neighborhoods. This is how you spot areas with genuine growth potential and steer clear of those that are already oversaturated.

Once you have a target in your sights, the real financial detective work starts. A proper financial analysis goes way beyond the listing price. You have to dig deep and uncover every potential cost to get an honest picture of how the property will actually perform.

- Due Diligence: This means a top-to-bottom inspection of the property’s physical health, a thorough review of any existing leases, and verifying all zoning and compliance paperwork is in order.

- Operating Expense Calculation: You have to realistically estimate everything. Think property taxes, insurance, any HOA fees, and what you’ll be on the hook for with utilities.

- Capital Expenditure Forecasting: This is about planning for the big-ticket items that will eventually need replacing—a new roof, an HVAC system, you name it. Planning for these now means you won't get blindsided later.

By running the numbers and stress-testing your assumptions, you can land on a competitive rental price that not only attracts good tenants but also keeps your cash flow healthy.

Mastering the Onboarding Process

As soon as the deal closes, the onboarding phase kicks in. This is a step people often rush, but getting it right sets the tone for everything that follows. A methodical onboarding process is your best defense against future headaches, from accounting messes to messy tenant disputes. Before you even think about finding tenants, you need to know about preparing your property for new tenants to guarantee a smooth start.

The goal here is simple: create a perfect, complete record of the asset from the moment it becomes yours.

Onboarding isn't just administrative work; it's risk management. Detailed documentation and clean financial separation are your best defense against legal issues and provide the clear data needed for smart decision-making.

A solid onboarding checklist ensures nothing gets missed. For every new property, you should consistently perform these key actions:

- Comprehensive Property Documentation: The first thing you should do is a detailed move-in condition assessment. Use high-resolution photos and videos to document every single room, appliance, and existing scuff or scratch. This visual proof is worth its weight in gold when it's time to handle security deposits.

- Dedicated Financial Setup: Open a separate bank account just for that property. Mixing funds is a classic mistake that leads to accounting chaos and serious legal risks. A dedicated account makes tracking income and expenses clean and simple.

- System Integration: Finally, get all the property's information loaded into your management software. This means everything—address, unit details, lease terms, and any known maintenance history. Getting the property into your system from day one creates a single, reliable source of information for managing it effectively.

When you handle these acquisition and onboarding steps with care, you’re priming the property for success. You’ve built a solid foundation that turns a simple building into a well-oiled machine, ready to generate predictable, long-term returns before the first tenant even has the keys.

Stage Two Operations and Tenant Management

If acquisition and onboarding are the launchpad, then Operations and Tenant Management is the mission itself. This is where the real work happens. It’s the engine room of the property management life cycle, the place where daily execution decides whether your asset soars or sinks. Get this stage right, and you're building long-term value; get it wrong, and you're just putting out fires.

This phase is all about being proactive, not just reacting to problems. It covers the entire spectrum—from finding and keeping great tenants to managing the finances with surgical precision. Success here isn't just a number; it means higher occupancy, predictable cash flow, and a more valuable asset when it's time to sell.

Attracting and Securing Quality Tenants

It all starts with turning an empty unit into a home for someone you can count on. This isn't a single action but a careful, multi-step process that begins long before a lease is ever signed.

1. Crafting Compelling Listings

Your rental listing is your storefront. In today's market, high-quality photos and 3D virtual tours aren't just nice-to-haves; they're essential. A good description does more than list features—it tells a story about the lifestyle, highlighting the neighborhood, the amenities, and what makes the place special for your ideal renter.

2. Implementing a Bulletproof Screening Process

This is probably the single most important step for protecting your investment. A solid, consistent screening process is your first and best defense against late payments, property damage, and evictions. Consistency is key here to stay compliant with fair housing laws. The non-negotiables are:

- Credit History: This gives you a snapshot of an applicant's financial discipline.

- Income Verification: A good rule of thumb is to verify that income is at least 3x the monthly rent.

- Rental History: Never skip calling previous landlords. This is where you uncover the real story and patterns of behavior.

- Background Check: A necessary step to identify any red flags that could pose a risk to the community or property.

3. Executing Ironclad Lease Agreements

Once you've found the right fit, the lease makes it official. This document needs to be a fortress—clear, comprehensive, and fully compliant with state and local laws. It should spell out every responsibility, rule, and procedure to leave no room for misunderstandings down the road.

Streamlining Day-to-Day Operations

With tenants settled in, the game shifts to efficiency. Modern property management software is the MVP here, acting as a command center for all your operational tasks. It takes what used to be a mountain of paperwork and manual follow-up and turns it into a smooth, automated workflow.

Operations aren't just about collecting rent; it's the art of creating a seamless experience for both the owner and the tenant. Technology automates the mundane, freeing you to focus on what truly matters—fostering relationships and preserving asset value.

So, what does great operations look like? It stands on a few key pillars.

- Automated Rent Collection: Online payment portals make life easier for everyone. Tenants can pay on time with a click, and you spend less time chasing checks. Automated reminders alone can dramatically cut down on late payments.

- Financial Management: This means obsessive budgeting, tracking every single expense, and producing crystal-clear owner reports. Every dollar has to be accounted for.

- Tenant Relationship Management: Happy tenants stay longer, and that directly impacts your bottom line. It’s as simple as responding to messages quickly, handling maintenance requests without delay, and keeping communication open. In fact, smart managers rely on proven https://clouddle.com/blog/tenant-retention-strategies/ to keep vacancy rates low.

The Bigger Picture: Portfolio Growth and Financial Health

While the daily grind is critical, it has to serve a larger purpose. For most property management companies, growing the portfolio is always a top priority. A 2025 Property Management Industry Report found that firms ranked portfolio growth as their number-one goal for the seventh year in a row.

But here’s the catch: they're trying to grow while operational costs are also on the rise. It’s a delicate balancing act. That’s why tracking Key Performance Indicators (KPIs) is so important—it’s how you keep your finger on the pulse of your business.

| Key Performance Indicator (KPI) | What It Measures | Why It Matters |

|---|---|---|

| Net Operating Income (NOI) | Property revenue minus operating expenses. | This is the true measure of a property's profitability. |

| Occupancy Rate | The percentage of rented units over a period. | A high rate means you're doing things right; a low rate is a warning sign. |

| Average Days on Market | The average time a unit stays vacant. | This tells you how efficient your leasing process is. The lower, the better. |

| Tenant Turnover Rate | The percentage of tenants who move out annually. | High turnover is a profit killer due to make-ready costs and lost rent. |

When you master the operations stage, you’re not just managing a property. You're running a well-oiled machine that minimizes risk, keeps tenants happy, and consistently delivers value for your clients.

Stage Three: Maintenance and Asset Preservation

If you ask most property managers, they’ll tell you maintenance is just a cost of doing business—a constant drain on the bottom line. But that’s a rookie mistake. Thinking that way completely misses the point. Smart maintenance is actually the engine that drives asset preservation. It's how you actively protect your investment and, more importantly, how you grow its value over time. It’s not about putting out fires; it’s about making sure they never start in the first place.

Think of your property like a classic car. You wouldn't just drive it until the engine seizes, right? Of course not. You’d do the oil changes, check the tires, and keep it tuned up. Proactive property maintenance works the exact same way, saving you from the catastrophic failures and eye-watering repair bills that are sure to come if you neglect it. On top of that, a well-cared-for property keeps your tenants happy, which means less turnover and fewer costly vacancies.

A Blended Maintenance Strategy is Key

There's no single "right" way to handle maintenance. The best approach is a blend of three different strategies, each playing a critical role in keeping the property in prime condition and maximizing its value down the road.

- Reactive Maintenance: This is your classic "break-fix" stuff. A tenant calls about a running toilet, you send a plumber. You can't avoid it entirely, but if this is your only strategy, you're running your business in the most expensive and chaotic way possible.

- Preventative Maintenance: This is where you start getting ahead. We're talking about scheduled tasks like having the HVAC serviced every spring, spraying for pests quarterly, and cleaning the gutters twice a year. These simple, planned activities stop tiny problems from snowballing into massive emergencies.

- Proactive Maintenance: This is the most forward-thinking approach. It’s all about looking at the big picture and identifying components that are nearing the end of their life—like that 15-year-old water heater or a roof that's seen better days. You plan for their replacement before they fail, saving you from a middle-of-the-night emergency call.

By weaving these three together, you build a truly resilient system that handles today's needs, prevents tomorrow's problems, and budgets for the long-term health of the asset.

Building a Proactive Maintenance Calendar

A proactive mindset needs a solid framework to work. An annual maintenance calendar is your best friend here, acting as a roadmap to ensure those crucial preventative tasks never fall through the cracks. It helps you organize everything by season, making your workflow predictable and much less frantic.

A maintenance calendar transforms asset preservation from a series of random emergencies into a predictable, manageable process. It’s the difference between being a firefighter and being an architect of your property’s long-term health.

Here’s what a simple seasonal calendar might look like:

- Spring: Get on the roof to check for winter damage, test all smoke and CO detectors, service the AC units before the first heatwave hits, and clear out the gutters.

- Summer: Inspect seals around windows and doors, check decks and patios for any safety issues or wear, and stay on top of landscaping and pest control.

- Autumn: Time to service the heating systems, inspect and clean chimneys, drain outdoor spigots to prevent frozen pipes, and double-check window and door seals for drafts.

- Winter: Keep an eye out for ice dams on the roof, make sure walkways and common areas are clear and safe from slip hazards, and check insulation in attics or crawl spaces.

This calendar is more than a simple to-do list; it’s a powerful financial planning tool. It allows you to accurately budget for routine expenses and creates a detailed history of upkeep—a huge selling point when it comes time to sell the property.

Efficiently Handling Tenant Repair Requests

Look, even with the world's best preventative plan, things are going to break. The key is how you handle those repair requests. You need a smooth, transparent process that keeps tenants in the loop and gets issues fixed fast. A slow or disorganized response is one of the quickest ways to lose a great tenant.

A workflow that actually works has a few key steps:

- Standardized Reporting: Give tenants an easy, consistent way to submit requests, preferably through an online portal. This ensures you get all the crucial details upfront, like photos and a clear description of what’s wrong.

- Triage and Prioritization: A burst pipe is not the same as a loose cabinet handle. You need to quickly assess the urgency and prioritize requests so true emergencies get handled immediately.

- Vendor Dispatch: Assign the job to a trusted, pre-vetted contractor. Having a network of reliable pros you can call on is absolutely essential for getting things done quickly and correctly.

- Communication and Follow-Up: This is huge. Keep the tenant informed every step of the way. Let them know when to expect the technician, and always follow up afterward to make sure they're happy with the repair.

- Final Sign-Off: Once the job is done, get everything documented. Save the invoices, photos, and notes in your management system. This digital paper trail is gold for financial tracking and liability protection.

Effectively managing repairs is a core part of the job, and a solid work order management system is non-negotiable for tracking everything from the initial report to the final payment. When you truly master this stage of the property management life cycle, you stop seeing maintenance as an expense. You see it for what it is: an investment in tenant satisfaction, operational efficiency, and the long-term appreciation of your asset.

Stage Four: Disposition and Value Realization

We've finally arrived at the last stage of the property management life cycle—the disposition. This is the moment where all your hard work, smart planning, and careful execution come to fruition. Disposition is more than just selling a building; it's about cashing in on its peak value and turning years of diligent management into a substantial financial win.

Think of this phase as the ultimate report card on your performance. Every decision you made, from those detailed move-in inspections to the proactive maintenance calls, now becomes a key selling point. The journey culminates here, proving that excellence in the earlier stages leads directly to a much more profitable exit.

Preparing the Asset for a Successful Sale

A successful sale doesn't start when you plant a "For Sale" sign on the lawn. It begins months earlier with a systematic approach designed to attract top-dollar offers and ensure a smooth closing without any eleventh-hour drama.

The first order of business is a thorough pre-sale inspection. This is a deep dive, not a quick walkthrough. You're looking for any deferred maintenance or small issues that could become big roadblocks during negotiations. Fixing a leaky faucet or touching up chipped paint now is far cheaper than giving a buyer a huge credit for it later.

Next, it’s time for a final, comprehensive market analysis. Real estate values can shift in the blink of an eye, and you want to price the property to sell—competitively, but for maximum value. This means digging into recent comparable sales, checking current inventory, and considering economic trends to find that sweet spot.

Leveraging Your Records as a Selling Tool

This is where all that meticulous record-keeping pays off in spades. The detailed documentation you’ve kept throughout the property's life is no longer just for your operational files—it’s now your most powerful marketing tool.

The disposition phase transforms your operational history into a compelling investment narrative. A clean, verifiable paper trail of income, expenses, and maintenance is the ultimate confidence-builder for a serious buyer, justifying your asking price and accelerating their due diligence.

Handing a potential buyer a complete, organized package of records builds instant trust and proves the property is a sound investment. Be ready to present:

- Rent Rolls: A clear history of consistent rental income is undeniable proof of performance.

- Maintenance Logs: A detailed log of all repairs and preventative work shows you’ve taken care of the asset.

- Expense Reports: Transparent financials give a clear picture of the property's Net Operating Income (NOI).

- Tenant Leases: Current leases provide certainty about future cash flow for the next owner.

This level of transparency makes your property stand out and can drastically shorten the buyer's due diligence period, leading to a faster, more secure closing. This kind of professionalism is becoming the standard. As of 2025, the worldwide property management market is valued at $27.8 billion USD and is expected to keep growing, showing a clear demand for more data-driven management. You can discover more insights about the global property market to see how these trends are shaping investment strategies worldwide.

Optimizing Your Life Cycle with Technology

Trying to run a modern property management business with spreadsheets and sticky notes is like navigating a busy highway while looking at a paper map. Sure, you might eventually get where you're going, but it's going to be slow, stressful, and you're bound to miss a few turns.

This is where good technology comes in. Think of an integrated property management system as the central nervous system for your entire portfolio. It connects everything, turning a reactive, fire-fighting job into a proactive, scalable business.

Instead of jumping between different programs and paper files, a single, powerful platform can handle every single stage. It can automate background checks during tenant screening, put rent collection on autopilot with online payments, and organize maintenance with digital work orders. This isn't just a nice-to-have; it's how you get ahead and stay ahead.

The Power of an Integrated System

A truly integrated tech stack makes the whole process feel seamless. It’s all about the flow.

When a potential tenant fills out an application on your website, that information doesn't just sit in an inbox. It automatically kicks off the screening process. Once they're approved, the system generates the digital lease for signature, creates their tenant portal, and lines up the automated rent reminders. Later, if they report a leaky faucet through that same portal, a work order is instantly created, assigned, and tracked until the job is done. This smooth handoff from one stage to the next is what prevents things from falling through the cracks.

Technology transforms property management from a list of disconnected chores into a single, cohesive system. This gives you the control and the data you need to make smarter decisions, protect your assets, and give both owners and tenants an experience they'll appreciate.

To really see the difference, let’s compare the old way of doing things with a modern, tech-forward approach.

Manual vs Tech-Enabled Property Management

This table breaks down how technology changes the game across the most common property management activities.

| Activity | Traditional (Manual) Approach | Optimized (Tech-Enabled) Approach |

|---|---|---|

| Leasing | Paper applications, manual background checks, phone tag. | Online applications, instant screening reports, automated follow-ups. |

| Rent Collection | Chasing paper checks, manual ledger entries, awkward reminders. | Automated online payments, instant transaction records, scheduled reminders. |

| Maintenance | Phone calls and sticky notes, disorganized vendor follow-up. | Digital work orders, tenant portal tracking, automated vendor dispatch. |

| Reporting | Manually compiling data in spreadsheets for owner reports. | Instant, customizable financial reports generated with one click. |

As you can see, the right tools don't just make the job easier; they fundamentally change how you operate.

Ultimately, getting the right technology in place is what separates the pros from the amateurs. It’s the key to unlocking real efficiency, boosting your bottom line, and delivering a level of service that keeps good tenants and happy owners. For a closer look at these tools, check out our deep dive into technology in property management and see how it’s shaping the industry.

Frequently Asked Questions

What Are The Most Critical KPIs In The Operations Stage?

When you're in the day-to-day operations phase, certain metrics act like a vital signs monitor for your property. If I had to pick the most critical, I'd focus on three:

- Net Operating Income (NOI): This is the bottom line. It tells you exactly how profitable your asset is after all the bills are paid.

- Occupancy Rate: This number shows you how well you're meeting market demand and if your marketing is actually working.

- Average Days on Market: This is all about efficiency. It reveals how quickly you can turn a vacant unit into an income-producing one.

Keeping a close eye on these KPIs allows you to stop guessing and start making sharp, data-backed decisions that really move the needle.

How Does Technology Impact The Disposition Stage?

When it comes time to sell, technology can be your single biggest advantage. Think about it: modern property management software gives you a perfect, verifiable history of everything related to that asset—every rent payment, every maintenance ticket, every single expense.

This digital record is absolute gold. It builds instant trust with potential buyers, gives them concrete proof to justify your asking price, and makes their due diligence process a breeze. A smooth due diligence almost always leads to a smoother, faster closing.

A complete and clean digital record from your management software is one of the most powerful tools in your arsenal during disposition. It proves the asset's performance and removes guesswork for the buyer.

What Is The Biggest Mistake In The Tenant Onboarding Process?

Without a doubt, the most common—and most expensive—mistake is skimping on the move-in inspection. Failing to take detailed photos and get a signed checklist from the tenant documenting the property's condition on day one is just asking for trouble.

It’s an oversight that almost always blows up into a messy security deposit dispute down the road. Sometimes, it can even land you in legal hot water. Proper, thorough documentation right at the start isn't just a good idea; it's non-negotiable.

At Clouddle Inc, we provide the integrated technology solutions that power every stage of the property management life cycle, from secure networking to automated systems that boost your NOI. See how our managed IT services can protect and enhance your assets at https://www.clouddle.com.