If you're in real estate, Net Operating Income (NOI) is the single most important number for gauging a property's financial health. Think of it as a property's true pulse. Before you even think about mortgages, financing, or income taxes, NOI shows you the raw profitability of the asset itself.

It’s the go-to metric for seasoned investors and lenders because it cuts through the noise and reveals how much money the property is actually making from its day-to-day business.

Your Property’s Profit Engine

Picture your property as a powerful engine. All the revenue it pulls in—rent checks, parking fees, laundry machine quarters—is the fuel. The costs to keep it humming along, like maintenance, insurance, and property management fees, are the heat and exhaust.

NOI is the pure, unadulterated horsepower that engine produces. It’s a clean look at performance before outside factors like loan payments or depreciation are considered.

The Two Sides of the NOI Coin

To get a handle on NOI, you just need to understand its two core parts. It’s a simple, but powerful, formula.

- Gross Operating Income (GOI): This is every single dollar the property brings in. It starts with the rent roll but also includes other income streams like pet fees, vending machines, or even revenue from shared Wi-Fi services.

- Operating Expenses (OpEx): These are all the necessary costs to keep the doors open and the tenants happy. We're talking about the essentials: property taxes, insurance, routine repairs, utilities, and management fees.

Subtract your Operating Expenses from your Gross Operating Income, and what's left is the property's core profit. Simple as that.

A property’s NOI provides a clear, apples-to-apples comparison against other properties, regardless of how they are financed. This universal benchmark is why lenders and investors rely on it to assess an asset's fundamental value and potential.

Why NOI Is the Foundation of Smart Investing

Getting a firm grasp on NOI is step one because nearly every other important real estate calculation flows from it. Lenders look at it to decide how much they're willing to loan. Investors plug it into formulas to determine a property's value, most notably the capitalization rate.

You can see that direct connection in our guide on how to calculate cap rate.

At the end of the day, a healthy, growing NOI signals a well-run asset. It’s not just a number on a spreadsheet; it’s the primary driver of value. Historical data from Cambridge Associates shows that income has consistently delivered approximately 70–80% of long‑term real estate total returns. That makes mastering your NOI the most critical skill for building lasting wealth in real estate.

How to Calculate Your Net Operating Income

Calculating your real estate NOI isn't complicated once you get the hang of the components. At its heart, the formula is a simple subtraction problem. Its real power comes from what it shows you: a property's true profitability before financing and taxes enter the picture.

The formula itself couldn't be simpler:

Gross Operating Income (GOI) – Operating Expenses (OpEx) = Net Operating Income (NOI)

This clean equation gives you a pure measure of a building’s performance. But to get an accurate result, you have to be meticulous about what you count as income and what you classify as an expense.

Unpacking Gross Operating Income

First up is Gross Operating Income (GOI), which is all the money a property actually generates. It’s not just about the rent roll; it’s about the real cash coming in after accounting for vacancies and adding in all those other little revenue streams.

To calculate your GOI, you’ll need to work with a few numbers:

- Gross Potential Rent (GPR): This is your ideal scenario—the total annual rent you’d collect if every single unit was occupied at full market rate, 100% of the time.

- Vacancy and Credit Losses: Reality check. This number accounts for income you lose from empty units or from tenants who don't pay their rent.

- Other Income: This is where you capture all the extra revenue streams. Think parking fees, laundry machines, pet fees, vending machines, or even your cut from a managed Wi-Fi service.

The formula to find your realistic income is: GPR – Vacancy/Credit Losses + Other Income = GOI.

Defining Your Operating Expenses

Next, you need to pin down your Operating Expenses (OpEx). These are all the necessary, day-to-day costs of keeping the property running. Getting this part right is absolutely critical for a trustworthy NOI figure.

Think of these as the essential "cost of doing business" for your building—the predictable expenses that keep it safe, clean, and functional for everyone.

Common operating expenses include:

- Property Taxes

- Property Insurance

- Utilities (for common areas)

- Repairs and Maintenance

- Property Management Fees

What to Exclude from the NOI Formula

Knowing what not to include is just as important. Mixing in the wrong expenses will completely throw off your calculation and could lead you to make some really bad investment decisions.

The goal of NOI is to isolate the property’s performance, so we intentionally leave out costs related to financing or the owner's personal tax situation.

The most common exclusions are:

- Mortgage Payments: This is a financing cost, not an operational one.

- Capital Expenditures (CapEx): Big-ticket items like a new roof or an HVAC overhaul are investments, not daily expenses.

- Depreciation: This is a "paper" expense for tax purposes; no actual cash leaves your account.

- Income Taxes: These depend on the owner's financial profile, not the building's efficiency.

To really nail this down, it’s helpful to see what to include and what to exclude side-by-side. For a deeper look, other guides often detail how to find net operating income with even more granular examples.

To keep it simple, here’s a quick-reference table.

NOI Calculation Inclusions and Exclusions

| Component Category | Include in Calculation | Exclude from Calculation |

|---|---|---|

| Income | All rental income, parking fees, laundry revenue, pet fees, amenity fees | Tenant security deposits (liability), loan proceeds |

| Expenses | Property taxes, insurance, utilities, routine maintenance, management fees | Mortgage payments, capital expenditures, income taxes, depreciation |

By sticking to this framework, you get a clean, apples-to-apples metric that lets you accurately judge a property's financial health on its own merits.

How Net Operating Income Plays Out in the Real World

The NOI formula itself is simple, but theory only gets you so far. The real magic happens when you see it applied to actual properties. Every asset class has its own quirks—different income streams, different expense structures—and understanding these nuances is what separates savvy investors from the rest.

Let's walk through three common scenarios to see how NOI really works on the ground.

Example 1: The Multifamily Apartment Building

Apartment buildings are often the first stop for real estate investors. The income is fairly straightforward—it’s mostly rent—but smart operators always look for ways to boost revenue through other services. On the flip side, expenses can be predictable, though things like tenant turnover can always throw a wrench in the works.

Let's picture a 50-unit apartment complex.

Figuring Out the Annual Income:

- Gross Potential Rent (50 units x $1,500/mo x 12): $900,000

- Vacancy Loss (at a 5% rate): -$45,000

- Other Income (parking, laundry, pet fees): +$20,000

- Gross Operating Income (GOI): $875,000

Tallying Up the Annual Operating Expenses:

- Property Taxes: $90,000

- Insurance: $25,000

- Utilities (for common areas): $18,000

- Repairs & Maintenance: $40,000

- Property Management (8% of GOI): $70,000

- Total Operating Expenses (OpEx): $243,000

Now, we just plug those numbers into our formula:

NOI = Gross Operating Income – Operating Expenses

$875,000 (GOI) – $243,000 (OpEx) = $632,000 (NOI)

That $632,000 is the number that matters. It’s the building’s pure, unadulterated profit before you even think about mortgage payments or big-ticket capital projects. This is the figure you’d use to judge just how well the property is performing.

Example 2: The Retail Strip Mall

Retail is a different beast altogether. Leases tend to be longer, and tenants often chip in for the property's upkeep through what are called Common Area Maintenance (CAM) charges. This little detail dramatically changes the NOI calculation.

Imagine a small strip mall with five storefronts.

Figuring Out the Annual Income:

- Gross Potential Rent: $300,000

- Vacancy Loss (one unit empty for 6 months): -$30,000

- CAM Reimbursements from Tenants: +$50,000

- Gross Operating Income (GOI): $320,000

Tallying Up the Annual Operating Expenses:

- Property Taxes: $45,000

- Insurance: $15,000

- Common Area Maintenance (landscaping, parking lot, etc.): $50,000

- Property Management (5% of GOI): $16,000

- Total Operating Expenses (OpEx): $126,000

Let's run the calculation for the strip mall:

NOI = Gross Operating Income – Operating Expenses

$320,000 (GOI) – $126,000 (OpEx) = $194,000 (NOI)

The $194,000 NOI here tells a good story. But notice how CAM charges pull double duty—they boost the income side while directly offsetting a major expense. You absolutely have to grasp this dynamic to accurately value a retail investment.

Example 3: The Industrial Warehouse

Industrial properties like warehouses are often the simplest of all, thanks to something called a "triple net" or NNN lease. With these long-term leases, the tenant is on the hook for property taxes, insurance, and maintenance. This arrangement strips the owner's expense sheet down to the bare minimum, making for an incredibly predictable NOI.

Let’s analyze a 100,000-square-foot warehouse.

Figuring Out the Annual Income:

- Gross Rental Income (from a NNN Lease): $800,000

- Vacancy Loss (fully leased): $0

- Gross Operating Income (GOI): $800,000

Tallying Up the Annual Operating Expenses (Owner's Side):

- Property Management (2% of GOI): $16,000

- Structural Repairs/Reserves (for the roof, etc.): $10,000

- Note: The big three—taxes, insurance, and maintenance—are all paid by the tenant.

- Total Operating Expenses (OpEx): $26,000

For a NNN property, the NOI calculation is almost laughably simple:

NOI = Gross Operating Income – Operating Expenses

$800,000 (GOI) – $26,000 (OpEx) = $774,000 (NOI)

As you can see, the final $774,000 NOI is nearly identical to the gross rent. This highlights just how passive and reliable an investment in a NNN-leased industrial property can be.

These examples make it clear: while the NOI formula never changes, the inputs are unique to every deal. Once you're comfortable with this, the next logical step is to see how investors use this number to value a property. You can learn exactly how to do that and calculate capitalization rate using Net Operating Income.

Why NOI Is the Most Important Metric in Real Estate

While the formula for NOI is simple, its importance is hard to overstate. It’s the universal language of property performance, letting investors, lenders, and appraisers all speak on the same terms. Think of it as a building's financial pulse.

NOI cuts straight through the noise of financing. One investor might use a large loan with high interest payments, while another pays all cash. These decisions can make a property's final cash flow look wildly different, but they say nothing about how well the building itself is actually performing.

By stripping away financing and taxes, NOI gives you a pure, apples-to-apples way to compare two properties.

Connecting NOI Directly to Property Value

The single biggest reason NOI reigns supreme is its direct, mathematical link to a property's market value. This connection is forged by the Capitalization (Cap) Rate, one of the most fundamental tools in commercial real estate.

The formula is beautifully simple: Value = Net Operating Income / Cap Rate.

This little equation reveals a powerful truth: as your NOI goes up, so does the value of your asset. If you can find a way to double your NOI while market cap rates stay the same, you’ve effectively doubled your property's worth. This is why savvy investors are obsessed with finding ways to nudge their NOI higher and higher.

Understanding this dynamic is the foundation for almost all strategies for selling commercial property, heavily reliant on NOI.

The Lender’s Perspective on NOI

Lenders are just as focused on NOI as investors are, but for a different reason: managing risk. Before signing off on a commercial mortgage, a lender’s main question is always, "Can this property's operations generate enough income to reliably cover the loan payments?"

To answer that, they use a metric called the Debt Service Coverage Ratio (DSCR). The calculation is DSCR = NOI / Total Debt Service.

Most lenders look for a DSCR of 1.25x or higher. In plain English, that means the property's NOI must be at least 25% greater than its annual mortgage payments. A strong, stable NOI gives the bank a critical safety cushion, assuring them that even if expenses creep up or a tenant leaves, there will still be enough income to avoid a default.

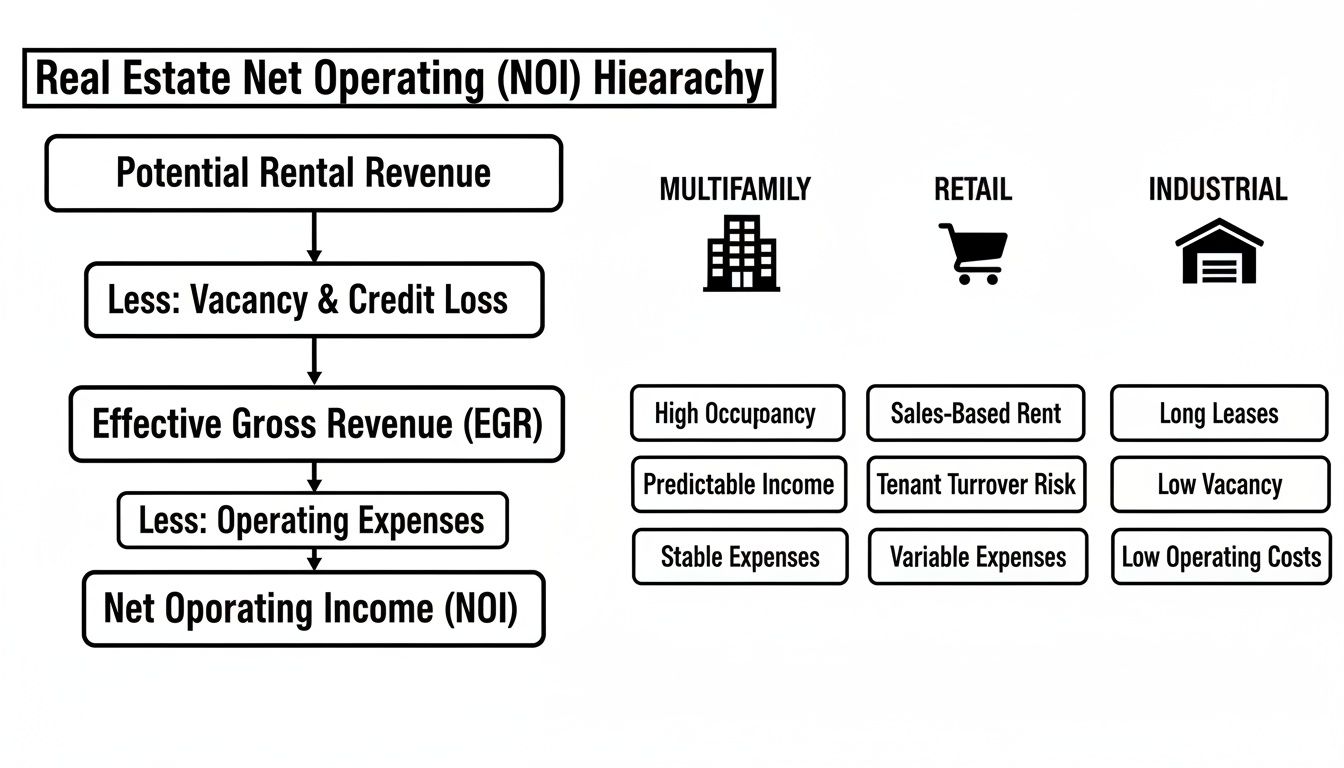

The infographic below shows how different property types—like multifamily, retail, and industrial—generate their unique NOI profiles from different income and expense structures.

As you can see, the core components of revenue and expenses differ, leading to distinct operational models and NOI characteristics for each asset class.

Ultimately, a property's NOI isn't just a line item on a spreadsheet. It’s the engine that drives its market value, secures financing, and determines whether an investment will succeed or fail.

Proven Strategies to Increase Your Property's NOI

Understanding your real estate NOI is step one. Actively improving it is where you actually build wealth. Think about it: every single dollar you add to your NOI doesn't just bump up your monthly cash flow—it directly inflates your property's market value. The best part? This is a game you control.

Boosting NOI really comes down to two things: you can either make more money from the property or spend less to run it. The savviest investors attack both sides at once, creating a powerful compounding effect on their bottom line.

This section is your playbook. We'll walk through practical, road-tested tactics for both revenue and expenses, covering everything from old-school methods to modern tech solutions that can give you a serious leg up.

Boosting Revenue Beyond the Rent Roll

The most obvious move to increase income is raising the rent, but that's just scratching the surface. A little creativity can unlock a whole host of new income streams, and if you do it right, you'll actually make your residents happier in the process—which is the secret to cutting down on costly vacancies.

Here are a few proven ways to get your gross operating income climbing:

- Introduce Amenity Fees: Got a great fitness center, pool, or co-working space? A modest monthly amenity fee can turn those from expenses into profit centers. You can also charge for reserving common areas for private events.

- Implement Tiered Services: Give tenants options to upgrade their experience. This could be anything from premium parking spots and in-unit laundry rentals to smart home packages with automated lighting and thermostats, all for a monthly fee.

- Add Pet-Related Charges: More and more renters have pets. A pet-friendly policy with a one-time pet fee plus monthly "pet rent" is a simple and widely accepted way to add a surprising amount to your revenue.

- Monetize Storage Space: Take a look at your property's underused spaces. That dusty basement or oversized closet could be converted into secure storage units you can rent out to tenants. It’s a win-win.

The trick is to offer services that residents find genuinely valuable. When you do that, you're not just adding fees; you're enhancing the living experience.

The Power of Technology in Revenue Generation

Today, technology offers some of the most potent ways to pump up your property's income. Managed tech services, in particular, can create entirely new revenue streams that also double as powerful marketing tools to attract and keep great tenants.

A fantastic example is offering property-wide managed Wi-Fi. Instead of forcing residents to call up the local cable company, you can provide a superior, high-speed connection as a built-in amenity. This is often bundled into a mandatory "tech package" fee, creating a steady, predictable new source of income.

By providing a hassle-free, reliable internet connection from day one, property owners can charge a premium, improve the resident experience, and generate thousands in additional annual income, directly impacting their real estate NOI.

What makes this even more appealing is that many of these services are available through a Network-as-a-Service (NaaS) model, meaning there's often zero upfront cost. You can get a state-of-the-art system installed without a huge capital outlay, making the return on your investment almost immediate.

Cutting Costs with Surgical Precision

Now for the other side of the NOI coin: your operating expenses. While some costs like property taxes are pretty much fixed, many others are ripe for reduction through smart management, tough negotiation, and technology. The goal isn't to be cheap; it's to be efficient and eliminate waste.

Effective cost-cutting always begins with a deep dive into your current spending. Pull out your profit and loss statement and go through it line by line, questioning everything.

You'll often find the biggest savings in these areas:

- Renegotiating Vendor Contracts: Never let contracts for landscaping, trash removal, or cleaning auto-renew. Make it a habit to get competitive bids. It keeps your vendors honest and ensures you're paying fair market rates.

- Auditing Utility Usage: Hunt for waste in water and energy consumption. Simple fixes like installing low-flow fixtures, switching to LED lighting in common areas, and adding smart thermostats can lead to huge long-term savings.

- Appealing Property Taxes: Property taxes are a massive line item. If you have reason to believe your property is over-assessed, hiring a professional to appeal the valuation could save you thousands of dollars a year.

- Focusing on Preventative Maintenance: It is always cheaper to prevent a problem than to fix it. A regular maintenance schedule for HVAC systems, plumbing, and roofing can save you from catastrophic (and expensive) failures later on.

Even small, incremental wins across a few categories can add up to a major reduction in your total operating expenses, pushing your NOI higher. For more detailed strategies, you might be interested in our dedicated guide on how to increase NOI.

Using Tech to Automate Savings

Just as technology can create new revenue, it’s also a beast at cutting operational costs. Automation and smart systems can handle routine tasks, reduce labor needs, and give you the data to make smarter spending decisions.

Think about managed security and access control systems. They can reduce the need for on-site guards, help lower your insurance premiums, and create a digital log of everyone who comes and goes. Or consider smart sensors that can detect a water leak before it turns into a flood, saving you from a five-figure repair bill and a massive insurance headache.

These performance differences highlight why a tailored approach to improving real estate NOI is so crucial. Recent market data shows that while overall NOI growth for U.S. REITs slowed in 2024, performance varied wildly by sector. Industrial REITs saw 5.8% same-store NOI growth and residential REITs hit 3.2%, but office REITs actually saw a -0.7% decline. This just underscores that your strategy has to match what's happening in your specific market.

Ultimately, every decision—from adding a new service to changing a light fixture—should be seen through the lens of its impact on your NOI. By systematically working to drive revenue up and push expenses down, you put your property on the fast track to greater profitability and a higher valuation.

Answering Your Top Questions About NOI

Once you start using Net Operating Income in your analysis, a few common questions always pop up. Getting the answers straight is key because these details are what separate NOI from other financial metrics and show you exactly what it’s designed to do.

Nailing these distinctions will sharpen your analysis and help you sidestep some of the most common mistakes investors make when sizing up a property.

What’s the Difference Between NOI and EBITDA?

This is a classic point of confusion, but it gets simple when you think about what each metric is focused on. NOI tells you how profitable the property is, all by itself. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) tells you how profitable the business that owns the property is.

NOI is a pure real estate metric. It deliberately ignores things like depreciation and amortization because those are just accounting entries—they don't reflect the actual cash performance of the building day-to-day. EBITDA, on the other hand, is a much broader business metric that gets used to compare companies across completely different industries.

Here’s an easy way to think about it: A real estate investor uses NOI to compare two apartment buildings head-to-head. A corporate analyst uses EBITDA to compare a real estate company to, say, a software company.

How Does a High Vacancy Rate Wreck Your NOI?

A high vacancy rate is a wrecking ball for your NOI. It hits you with a nasty one-two punch. First, the obvious hit: it hammers your revenue. Every empty unit is lost income, which means your Gross Operating Income takes a nosedive.

But the damage doesn't stop there. Vacant properties often cost more to run. You’re spending more on marketing to find tenants, and you’re still paying for utilities to keep those empty units presentable for showings. This combo of less money coming in and more money going out makes your NOI plummet.

Can NOI Be Negative? What Does That Mean?

Absolutely. A negative NOI is a massive red flag. It means the property's operating expenses are higher than its income. Plain and simple, the property is losing money before you even think about paying the mortgage.

A negative real estate NOI is a clear signal of a deeply distressed asset. It points to serious underlying issues—like rampant vacancy, out-of-control expenses, or just plain mismanagement—that demand immediate and drastic action.

When NOI is negative, the owner has to pour their own cash into the property just to cover daily costs. It's a completely unsustainable situation that signals a failing investment that needs either a major turnaround or a quick sale to stop the bleeding.

Are Capital Expenditures Included in NOI?

No, and this is probably the most important distinction to get right. Capital Expenditures (CapEx) are never included in the NOI calculation. Operating expenses are the routine, day-to-day costs of keeping the property running—think insurance, utilities, and minor repairs.

CapEx, however, are major investments that improve the property or extend its life. We're talking about big-ticket items like:

- Replacing the entire roof

- Installing a new HVAC system

- Repaving the parking lot

- A complete lobby renovation

These aren’t daily costs; they're long-term investments in the building itself. NOI excludes them to give you a clean, consistent snapshot of operational performance. But smart investors always, always budget for CapEx separately. Forgetting to plan for these future costs is one of the quickest ways to see an investment that looks great on paper turn into a cash-draining nightmare.

At Clouddle Inc, we specialize in managed technology solutions—like property-wide Wi-Fi, integrated security, and smart automation—that are proven to increase revenue streams and reduce operating costs, directly boosting your NOI. Discover how our Network-as-a-Service model can enhance your property's value with zero upfront investment. Learn more at https://www.clouddle.com.